Available Insurers

Tailor Your Plan, Your Way

Pick the benefits that work best for you

@metafin_official Explanation Campaign MetaFin 11.11 Ramai customer MetaFin yg salah faham tentang promo Nov ni. Meh saya explain. Campaign Nov ada 3 kategori dan 3 promo code. - Untuk kenderaan yg ‘subtotal’ berharga <RM1000, boleh guna promo code New20. - Untuk kenderaan yg ‘subtotal’ berharga >RM1001, boleh guna promo code MetaFin50. - Untuk kenderaan yg ‘subtotal’ berharga >RM2001, boleh guna promo code MetaFin50. Jelaskan…. Haaa, korg ape tunggu lagi. Cepat tekan link kat BIO dan grab sekarang sebelum 30 Nov 2025. #promo25 #insuranskereta #metafindigitalplatform #insuranskeretaonline #fyp ♬ original sound - MetaFin DIY Digital Platform

@metafin_official #fyp #metafindigitalplatform #insurance #jem #xzyabc ♬ original sound - MetaFin DIY Digital Platform

@metafin_official Ramai tak tahu, harga windscreen coverage bukan main hentam je. Jom saya tunjuk cara kira yang betul 🚘 💡Like & Share jika bermanfaat! Bila renew insurans, windscreen coverage ikut harga cermin kereta korang. Contoh: kalau cermin RM1,000, premium biasanya 15% je = RM150. Simple kan? Jangan bayar lebih, jangan under-insured. Next time renew, pandai-pandai check dulu! #insuranskereta #windscreencoverage #metafincarinsurance #renewinsurans #tipskereta ♬ original sound - MetaFin DIY Digital Platform

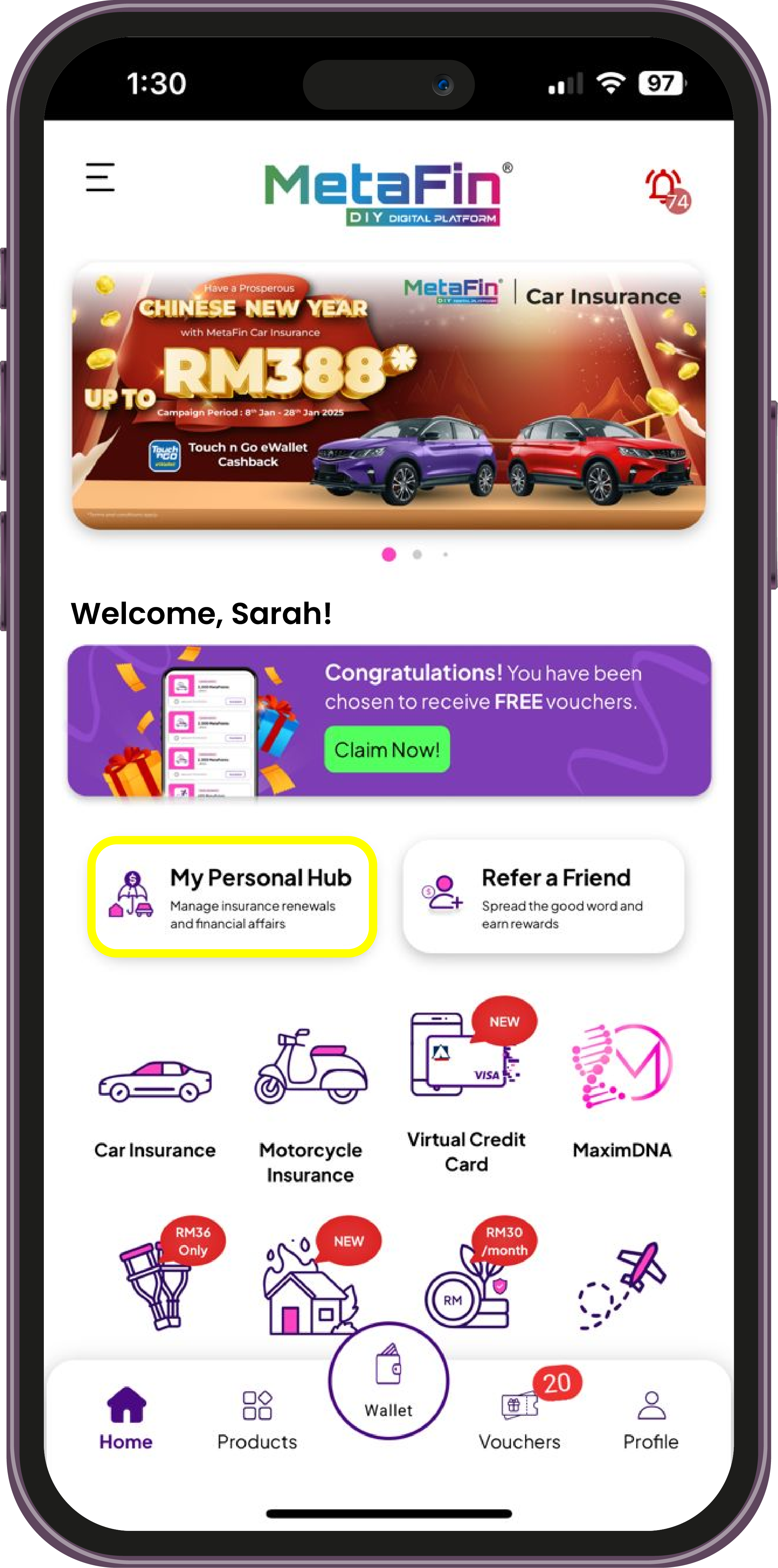

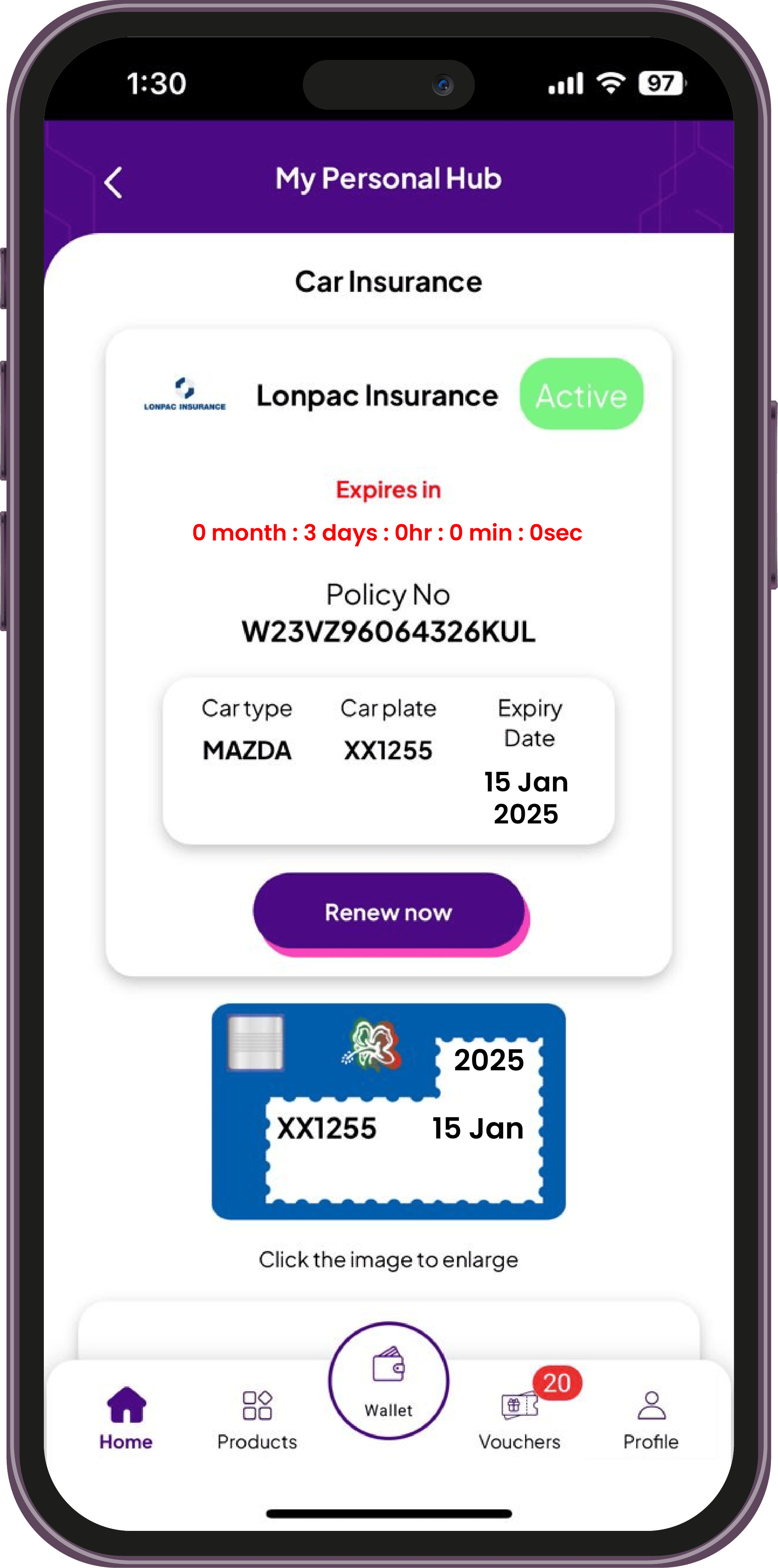

We Can Help You Renew Your Road Tax!

Get your vehicle road-ready by renewing your road tax with MetaFin Digital App. Complete everything with just a few taps in the app!

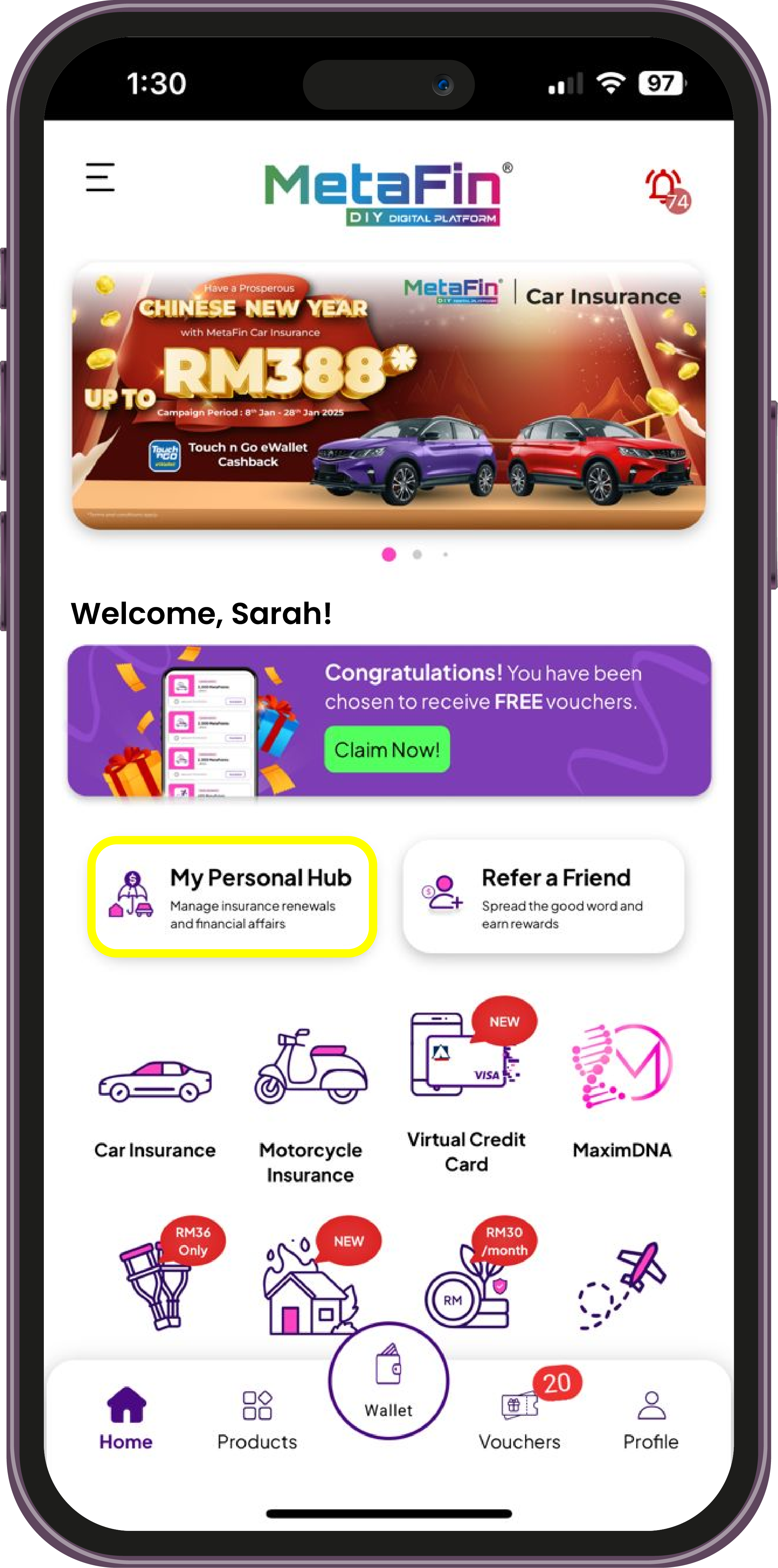

Renew Now!Easy access to your policy

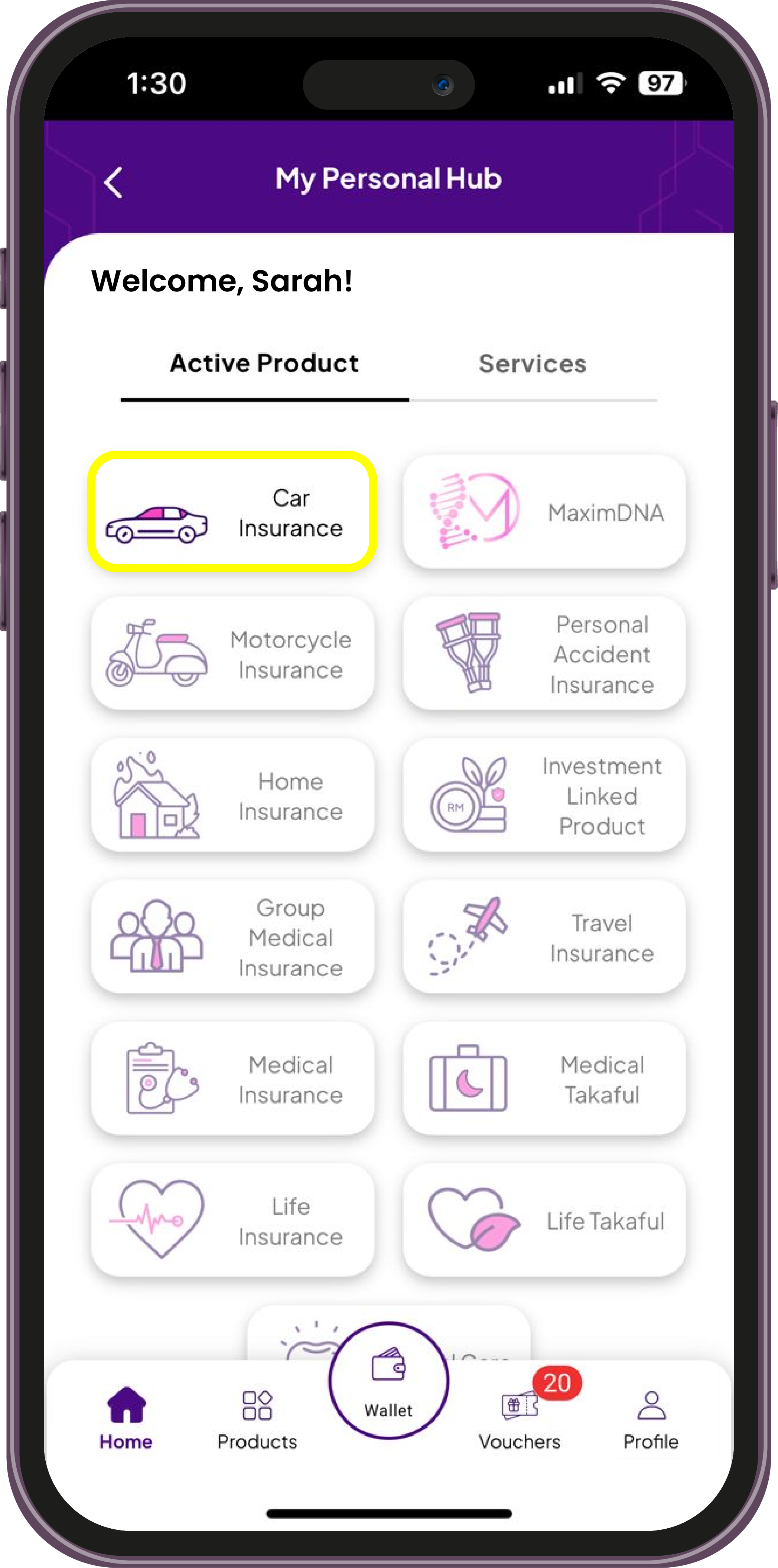

01

02

Click the "Car Insurance" button

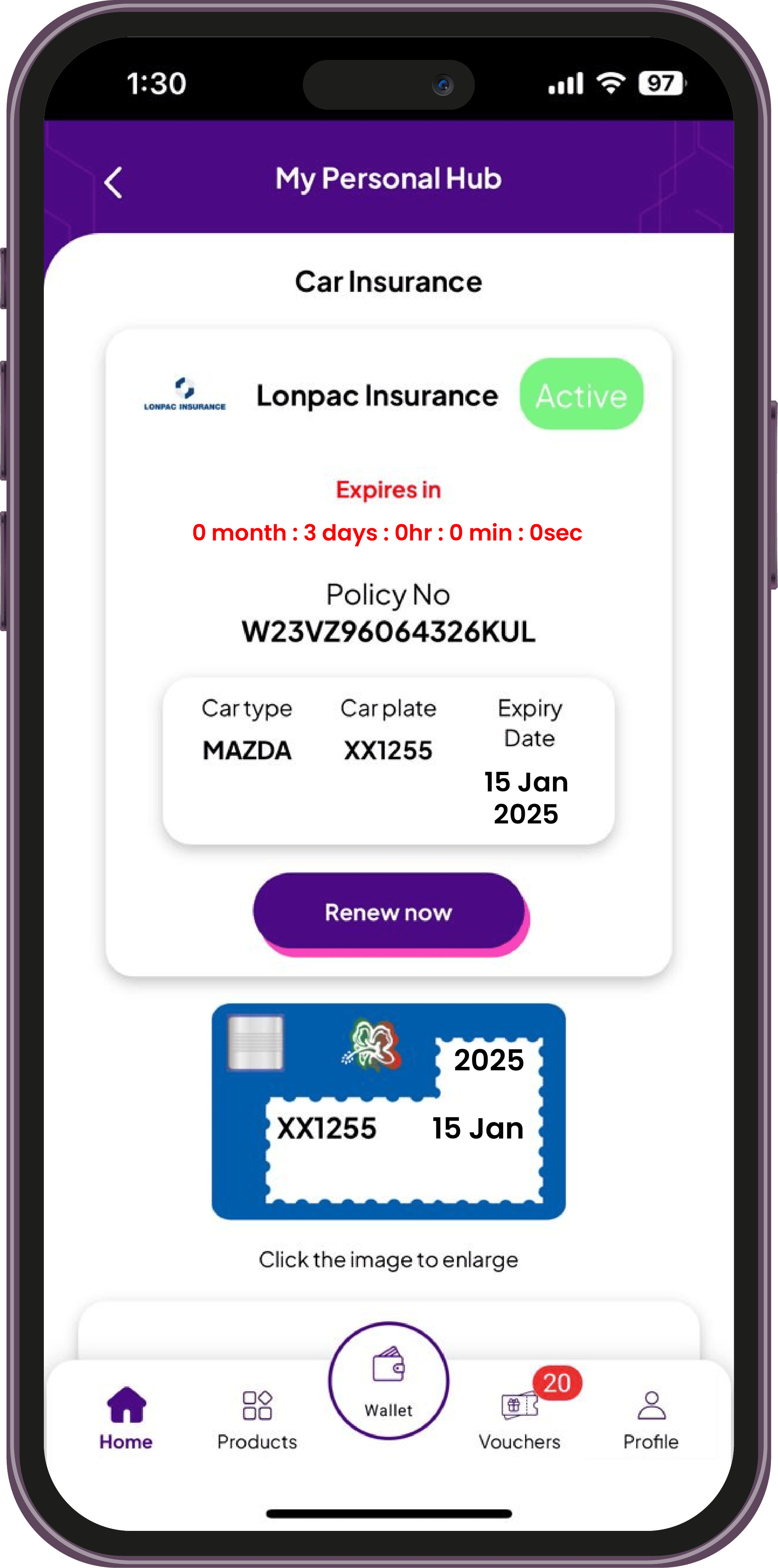

03

You can view your policy number, expiry date, and insurer information at a glance.

Happy MetaFin Users' Reviews

Latest Tips & Trends

Discover expert advice, style inspiration, and product updates on our blog.