Lite on Price, Full on Coverage!

With eHome Lite, your budget shouldn’t stand in the way of securing your home sweet home.

Discover the Benefits

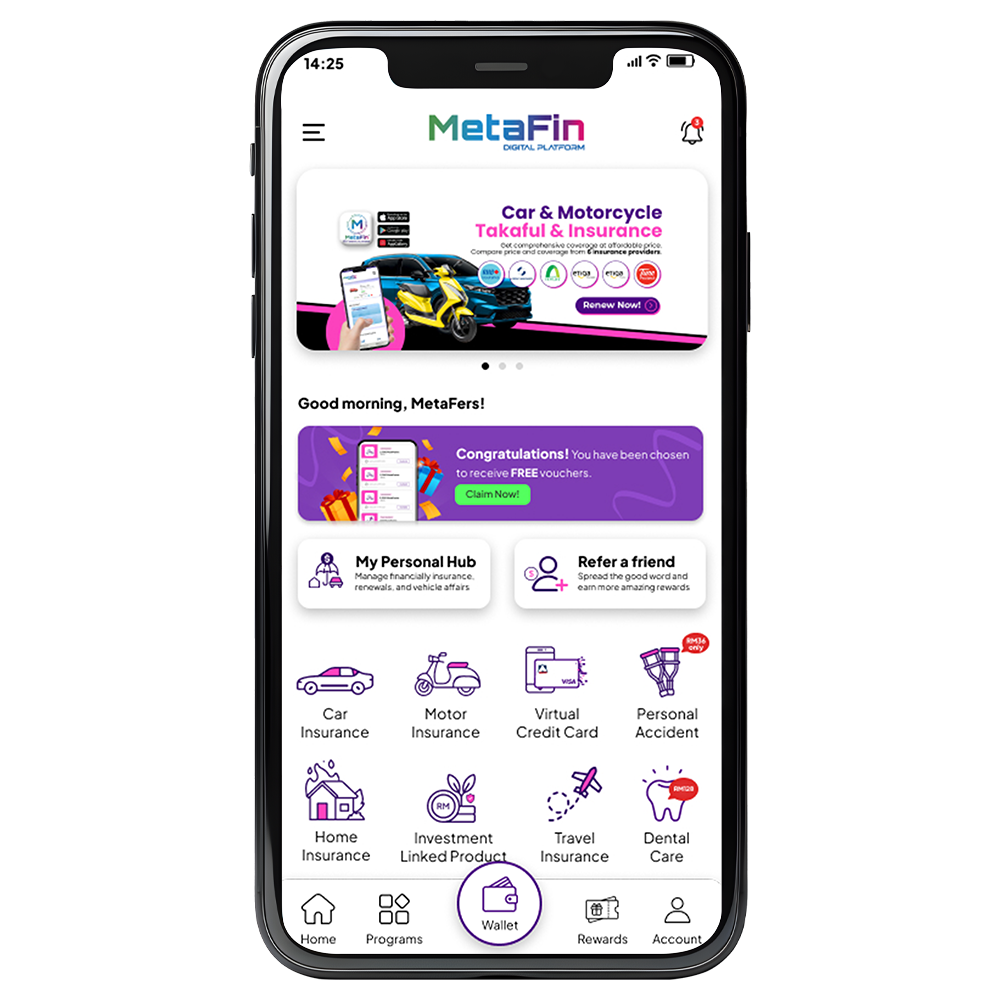

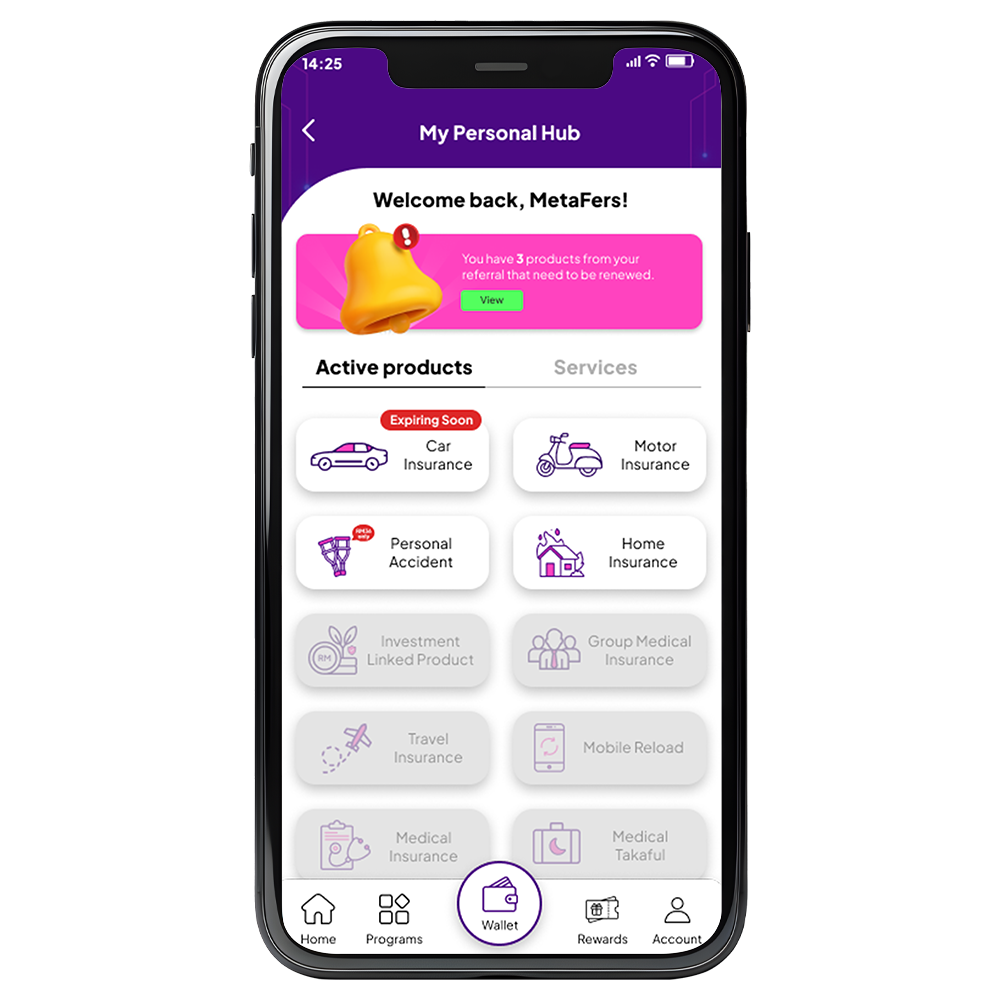

How to buy

Simple steps to

purchase eHome Lite

Fill in the Participant Particulars & necessary details

Choose payment provider and done!

Hassle-free Claims

Submit your claim

easily without worries!

Download and fill up the claim form.

Claim Form

Submit the claim form along with the supporting documents to cs@metafin.com.my

Your claim will be reviewed accordingly and if approved.

FAQ

Frequently Asked Questions

References

Important Documents

Disclaimer: Home Insurance (eHome Lite by Tune Protect) is underwritten by Tune Insurance Malaysia Berhad registered by PIAM and Pathlab Health Management (M) Sdn. Bhd. has been appointed to act as an authorized insurance agency. The information may not fully reflect the context of the product disclosure sheet and full terms of the policy. Please refer to the policy documents for a detailed description of the product’s features and conditions without any claims are made. MetaFin is not liable for misinterpretation of the product benefits and claim conditions as described in the policy wording sheet and policy disclosure sheet. For any claims assistance, complains or product information, please contact us at productinquiry@phm.com.my for further assistance.