Available Insurers

@metafin_official Promo Diskaun Chinese New Year yang tak boleh terlepas. Sekali nampak mesti grab punya. Jangan lepaskan peluang! Klik link di Bio sekarang👆🏻 #promocny #cny2026 #metafindigitalplatform #insuranskeretaonline #insurancetips ♬ Gemini - So Lis

@metafin_official 🚨 Makluman Pemandu E-Hailing Harga insurans e-hailing extension telah meningkat. Anggaran harga kini sekitar RM975, berbanding sekitar RM500 sebelum ini. Sila ambil maklum sebelum membuat pembaharuan insurans. #metafindigitalplatform #insuransehailing #ehailingextension #ehailingMalaysia #insuranskereta ♬ original sound - metafin_official

@metafin_official Ramai tak tahu, harga windscreen coverage bukan main hentam je. Jom saya tunjuk cara kira yang betul 🚘 💡Like & Share jika bermanfaat! Bila renew insurans, windscreen coverage ikut harga cermin kereta korang. Contoh: kalau cermin RM1,000, premium biasanya 15% je = RM150. Simple kan? Jangan bayar lebih, jangan under-insured. Next time renew, pandai-pandai check dulu! #insuranskereta #windscreencoverage #metafincarinsurance #renewinsurans #tipskereta ♬ original sound - MetaFin DIY Digital Platform

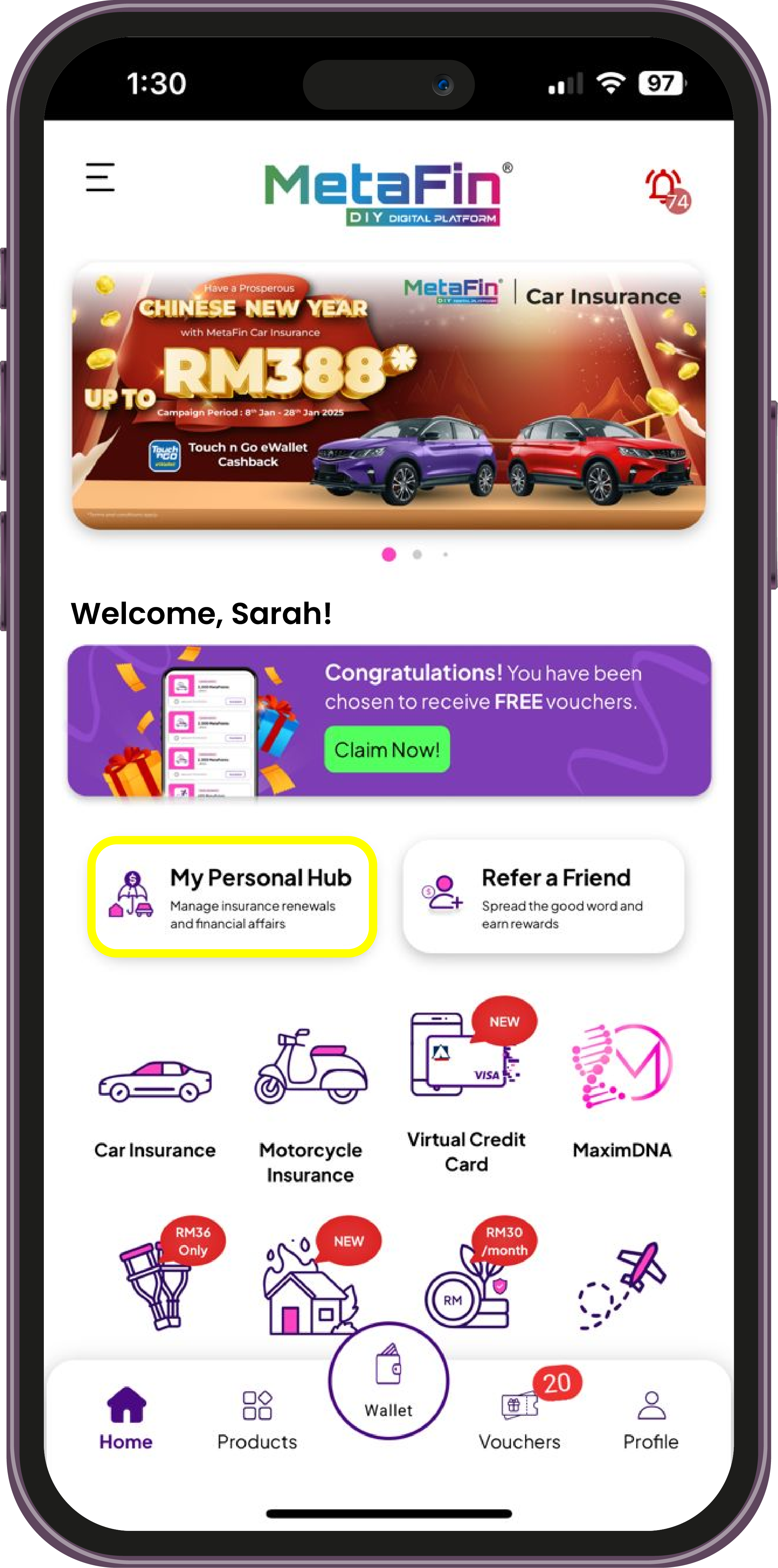

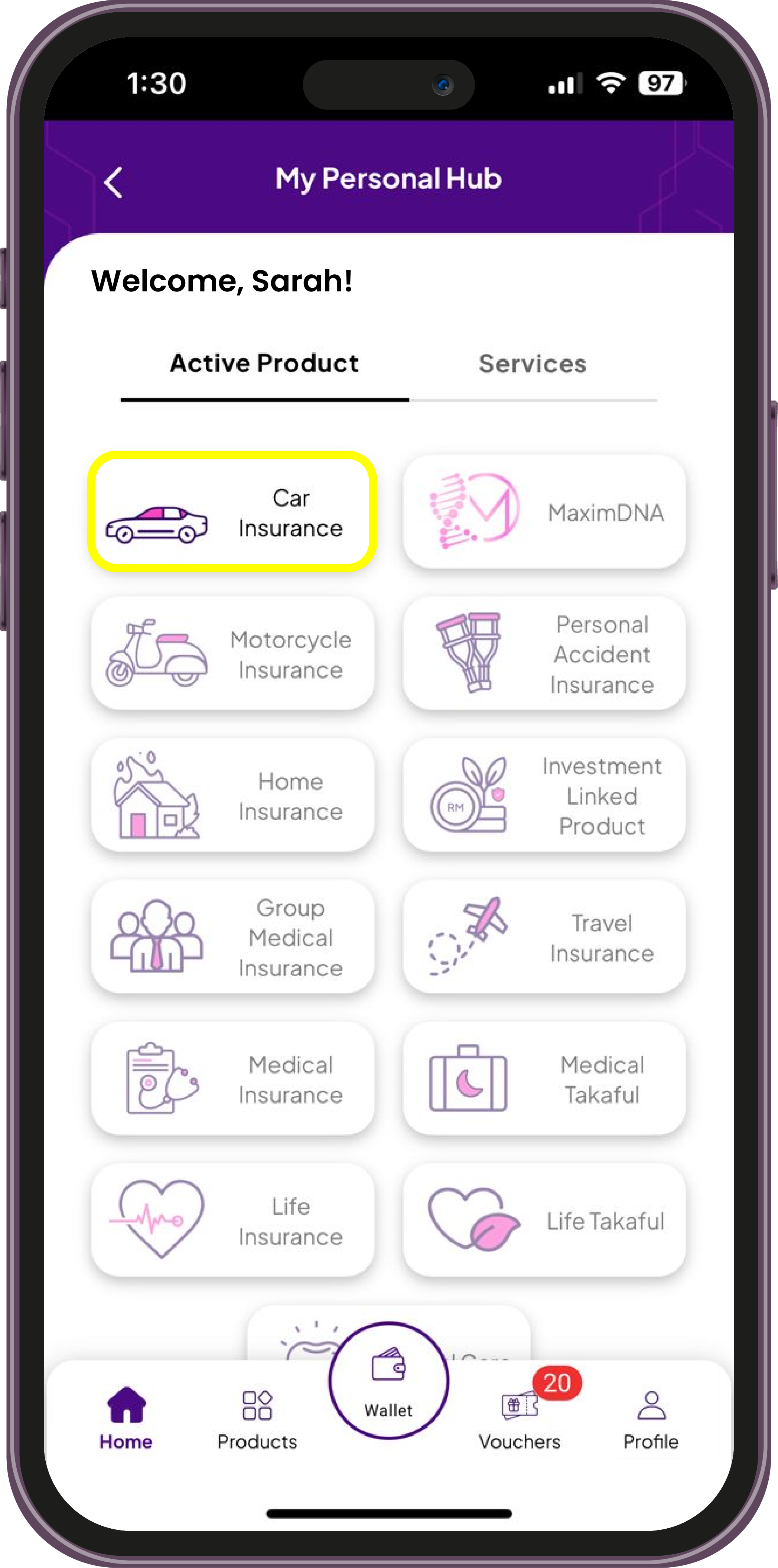

We Can Help You Renew Your Road Tax!

Get your vehicle road-ready by renewing your road tax with MetaFin Digital App. Complete everything with just a few taps in the app!

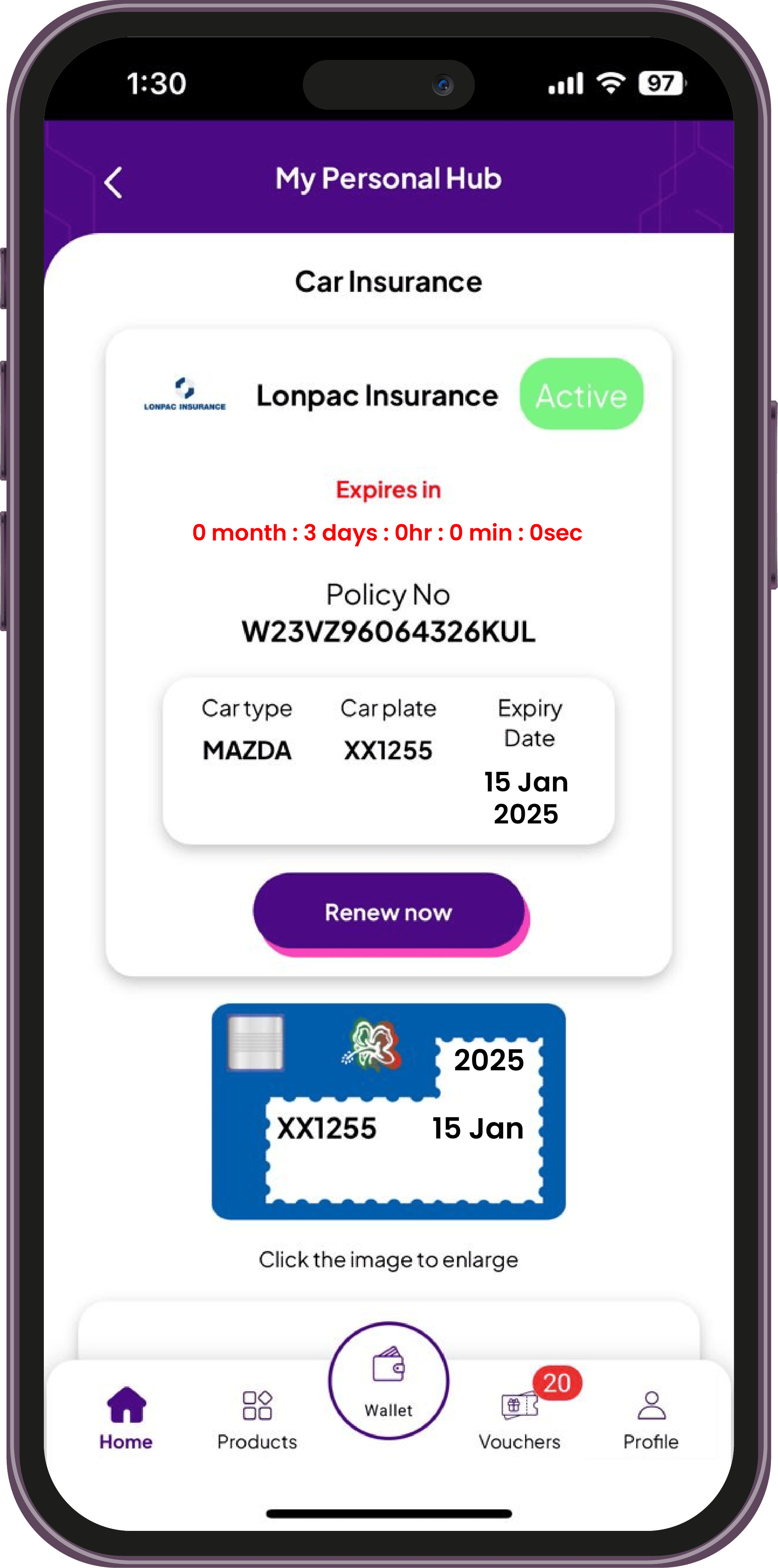

Renew Now!Easy access to your policy

Click the "Car Insurance" button

You can view your policy number, expiry date, and insurer information at a glance.

Happy MetaFin Users' Reviews

Latest Tips & Trends

Discover expert advice, style inspiration, and product updates on our blog.

Disclaimer: MetaFin is a neutral digital platform, serving solely as a facilitator and marketplace and not a product provider. MetaFin facilitates listings independently offered by licensed corporate insurance and takaful agencies, and other service providers directly to end users. MetaFin does not endorse, or manage any insurance or takaful products. Each corporate agency is fully responsible for its own product content, compliance, and transactions conducted through the MetaFin platform. Participating agencies must comply with Financial Services Act 2013 (FSA) and/or the Islamic Financial Services Act 2013 (IFSA) by Bank Negara Malaysia (BNM). Tune Insurance Malaysia Berhad is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Tune Insurance Malaysia Berhad or PIDM (visit www.pidm.gov.my).