Available Insurers

Tailor Your Plan, Your Way

Pick the benefits that work best for you

@metafin_official #fyp #metafindigitalplatform #insurance #jem #xzyabc ♬ original sound - MetaFin DIY Digital Platform

@metafin_official Ramai tak tahu, harga windscreen coverage bukan main hentam je. Jom saya tunjuk cara kira yang betul 🚘 💡Like & Share jika bermanfaat! Bila renew insurans, windscreen coverage ikut harga cermin kereta korang. Contoh: kalau cermin RM1,000, premium biasanya 15% je = RM150. Simple kan? Jangan bayar lebih, jangan under-insured. Next time renew, pandai-pandai check dulu! #insuranskereta #windscreencoverage #metafincarinsurance #renewinsurans #tipskereta ♬ original sound - MetaFin DIY Digital Platform

@metafin_official Cara-cara claim bila kena Bencana Alam #fyp #metafindigitalplatform #insurance #bencanaalam #zxycba ♬ original sound - MetaFin DIY Digital Platform

We Can Help You Renew Your Road Tax!

Get your vehicle road-ready by renewing your road tax with MetaFin Digital App. Complete everything with just a few taps in the app!

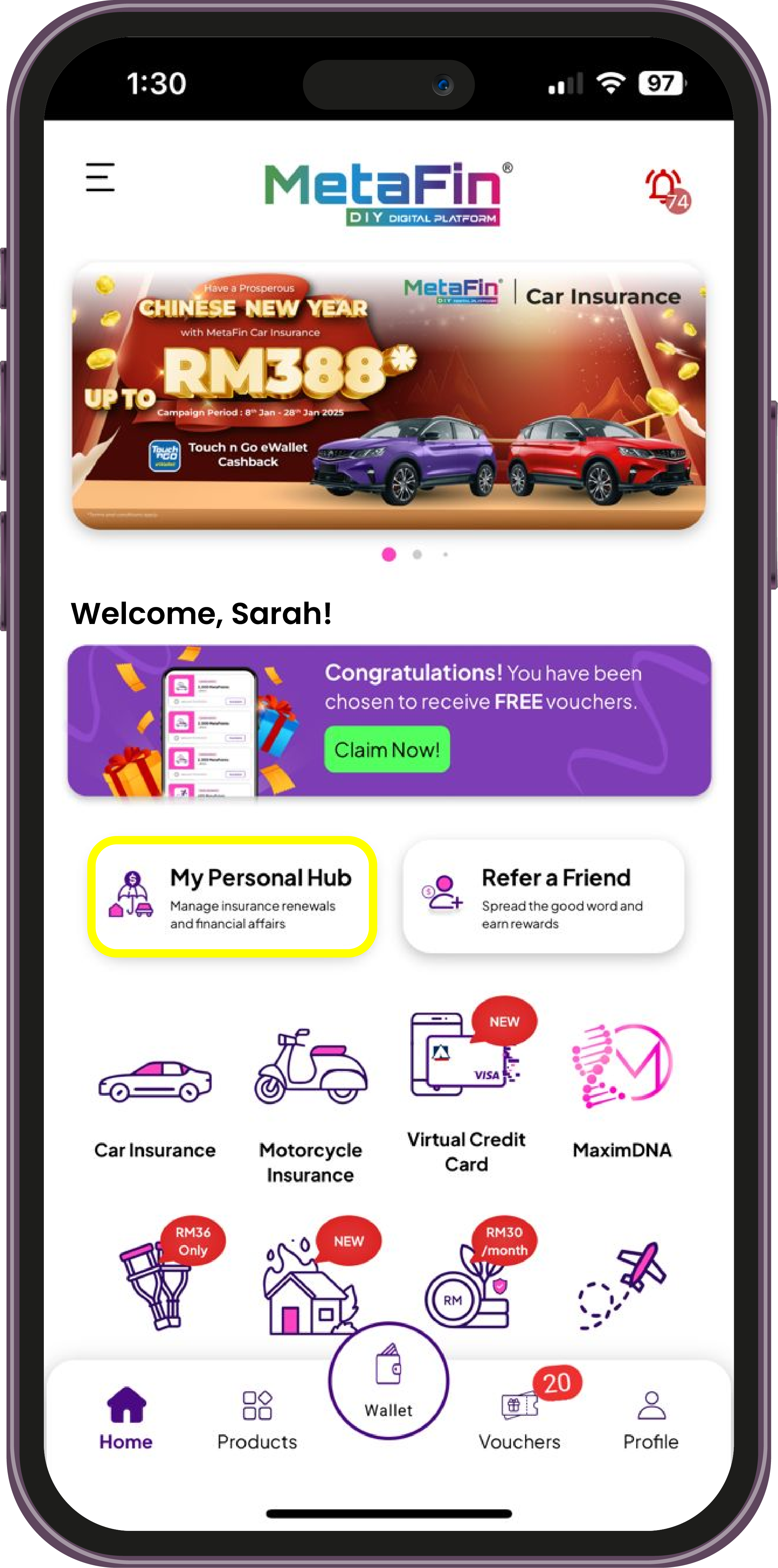

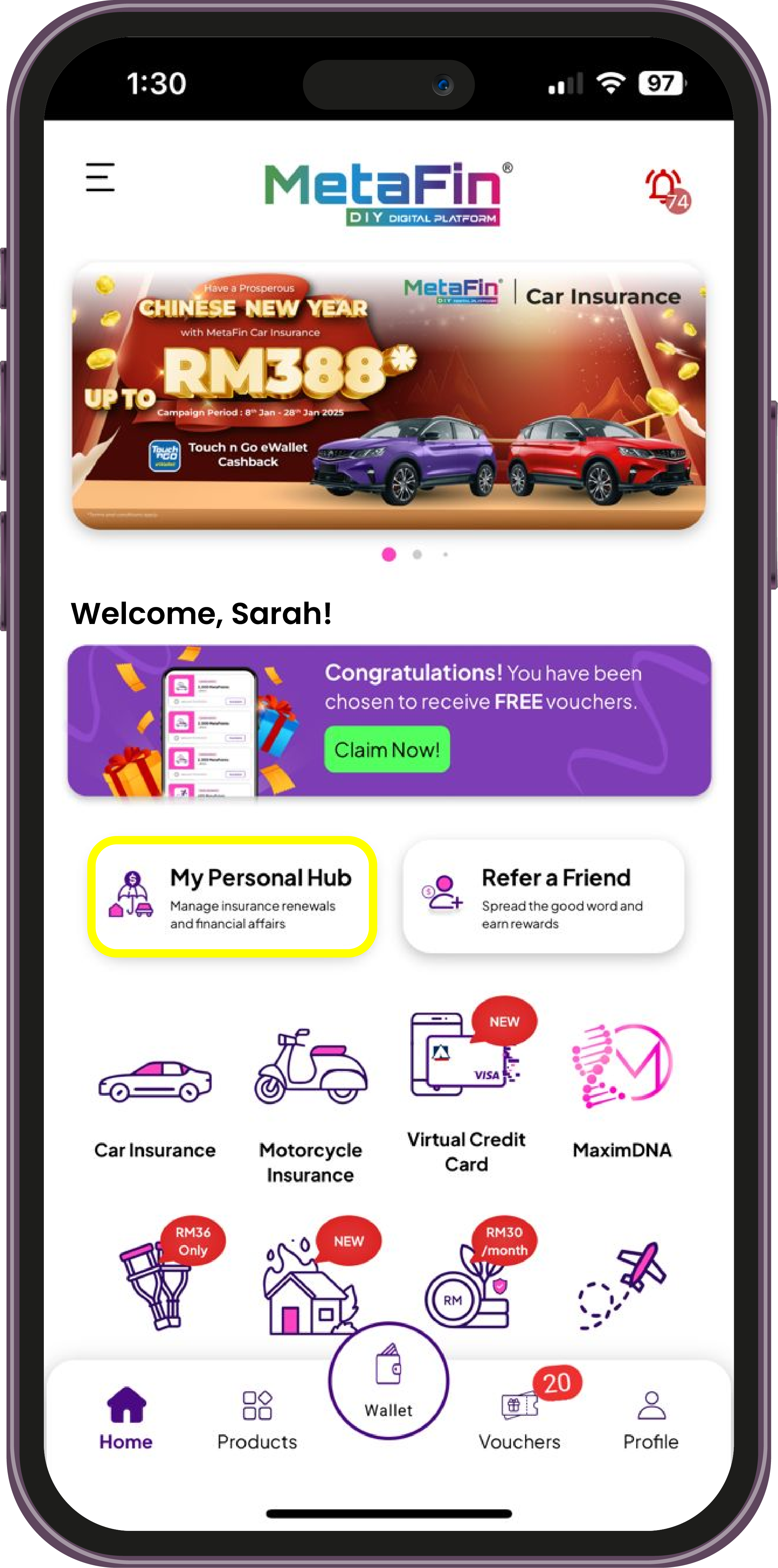

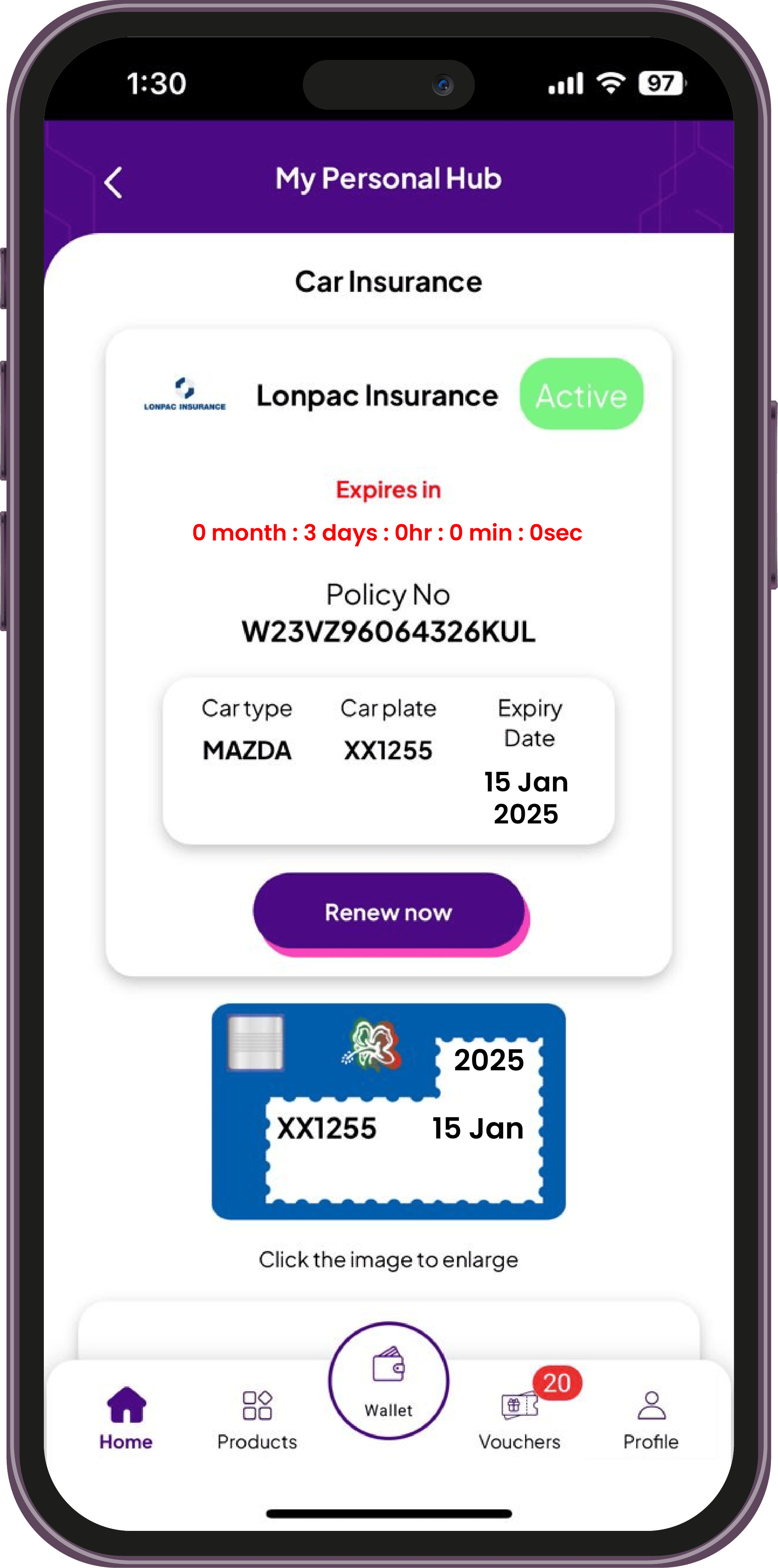

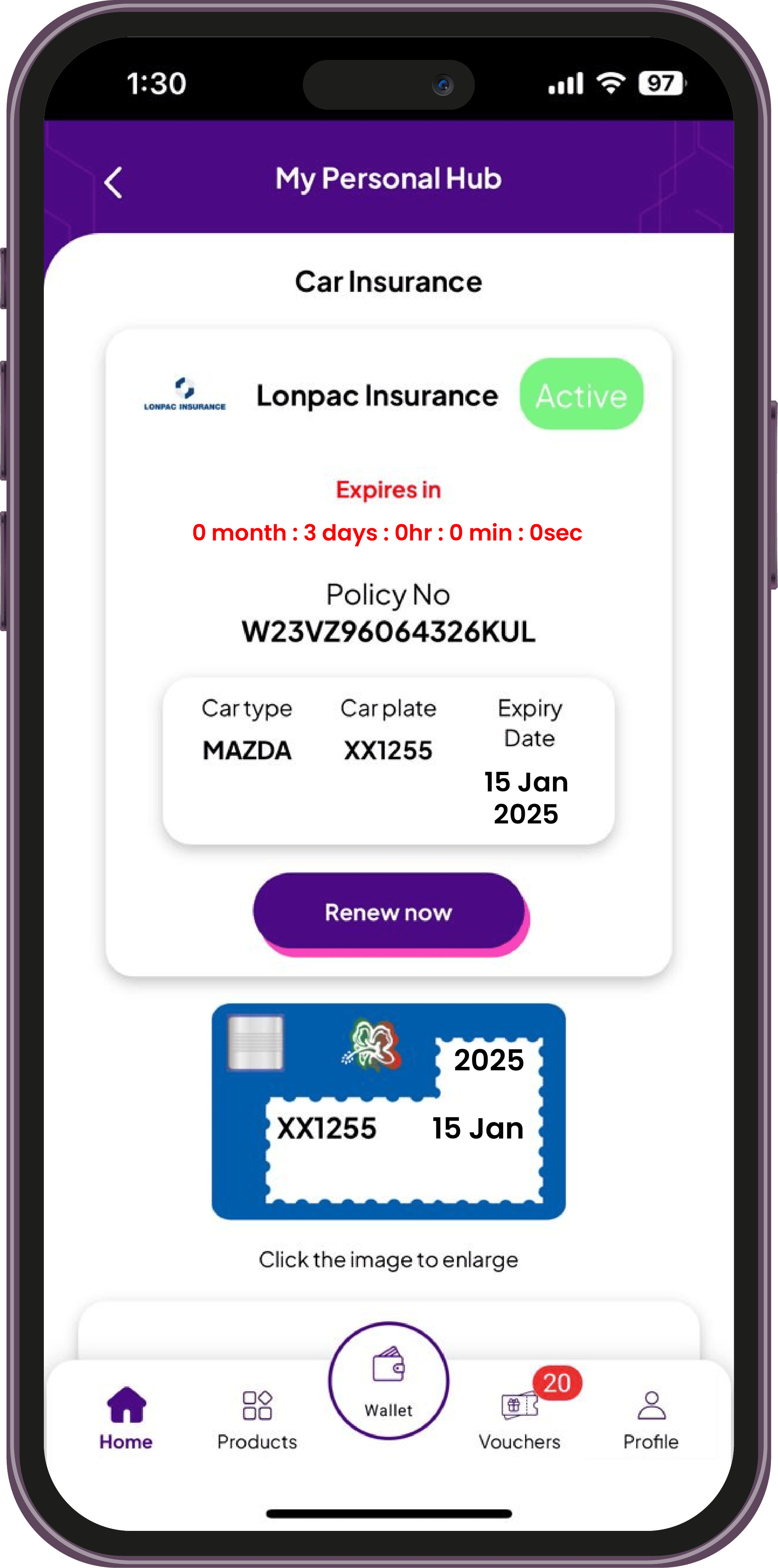

Renew Now!Easy access to your policy

01

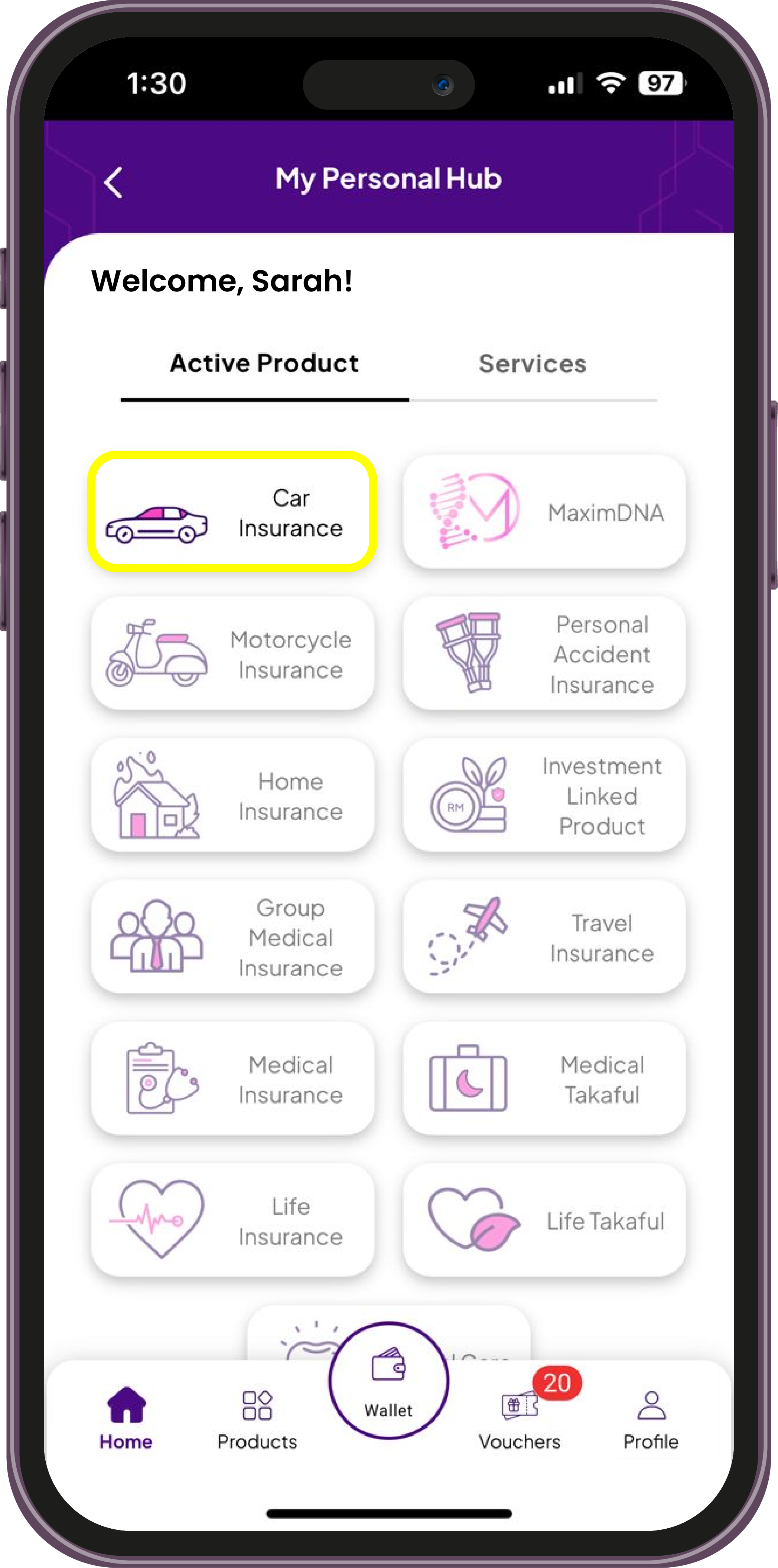

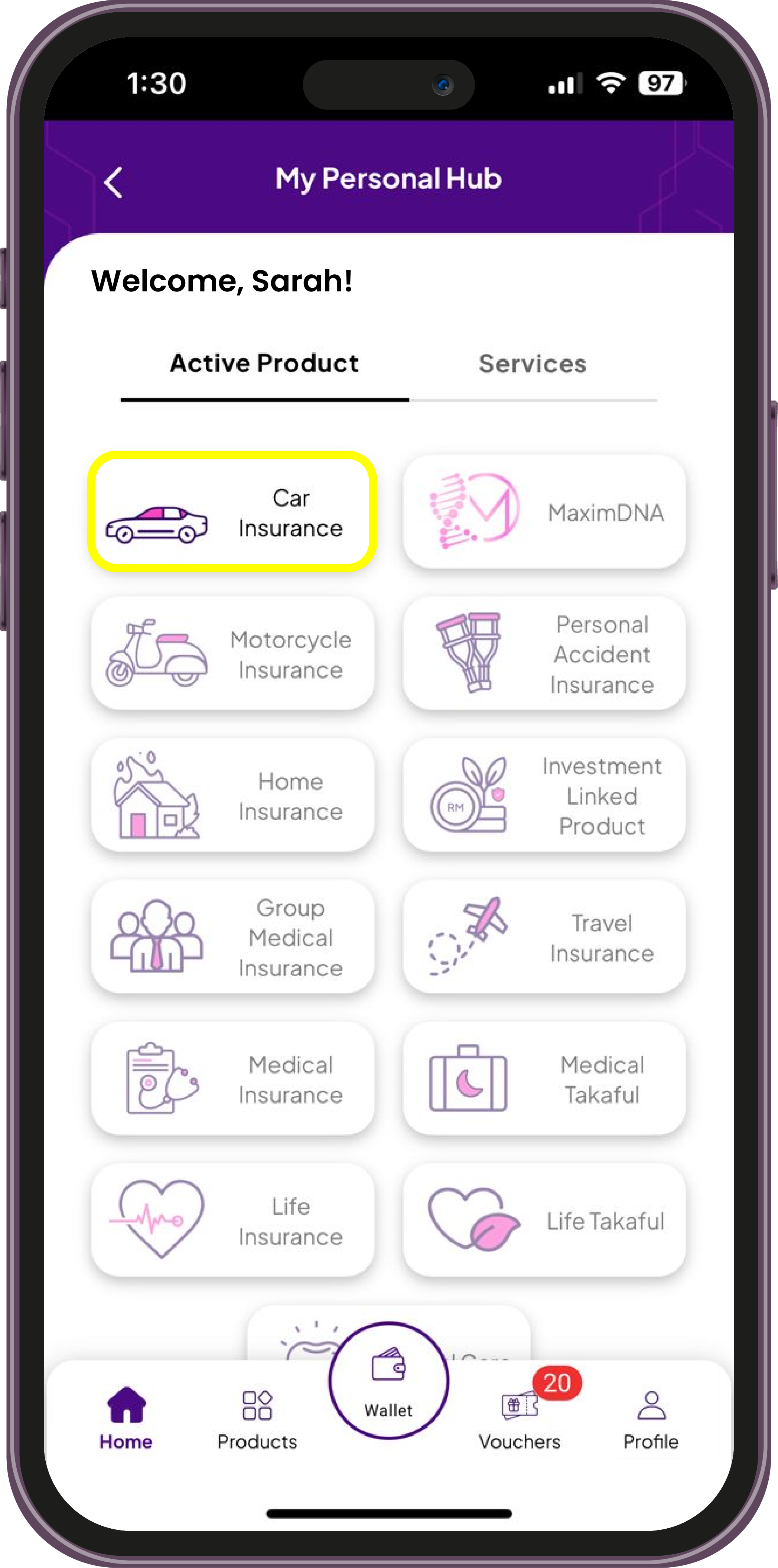

02

Click the "Car Insurance" button

03

You can view your policy number, expiry date, and insurer information at a glance.

Happy MetaFin Users' Reviews

Latest Tips & Trends

Discover expert advice, style inspiration, and product updates on our blog.

Opps! Something not right