Flat Rate for All Age Groups

Life Insurance with

Potential Investment Return

Up to

RM120,000 coverage

Authorised Insurance Agency:

Underwritten By:

Discover Our 8 Great Benefits

Pricing Plan

Find the Right Plan

Plan 30

/ Monthly

- 45 Critical Illnesses Coverage Up to RM30,000

- Death (natural cause/illness) Coverage Up to RM30,000

- Total and Permanent Disability(TPD) due to illness Coverage Up to RM30,000

- Accidental Death Coverage Up to RM60,000

- Total and Permanent Disability(TPD) due to accident Coverage Up to RM60,000

- Up to RM30 daily hospitalization income for up to 500 days per life

- Funeral expenses up to RM5,000

- Total Investment Value(TIV) based on Net Asset Value(NAV)

Plan 60

/ Monthly

- 45 Critical Illnesses Coverage Up to RM60,000

- Death (natural cause/illness) Coverage Up to RM60,000

- Total and Permanent Disability(TPD) due to illness Coverage Up to RM60,000

- Accidental Death Coverage Up to RM120,000

- Total and Permanent Disability(TPD) due to accident Coverage Up to RM120,000

- Up to RM60 daily hospitalization income for up to 500 days per life

- Funeral expenses up to RM5,000

- Total Investment Value(TIV) based on Net Asset Value(NAV)

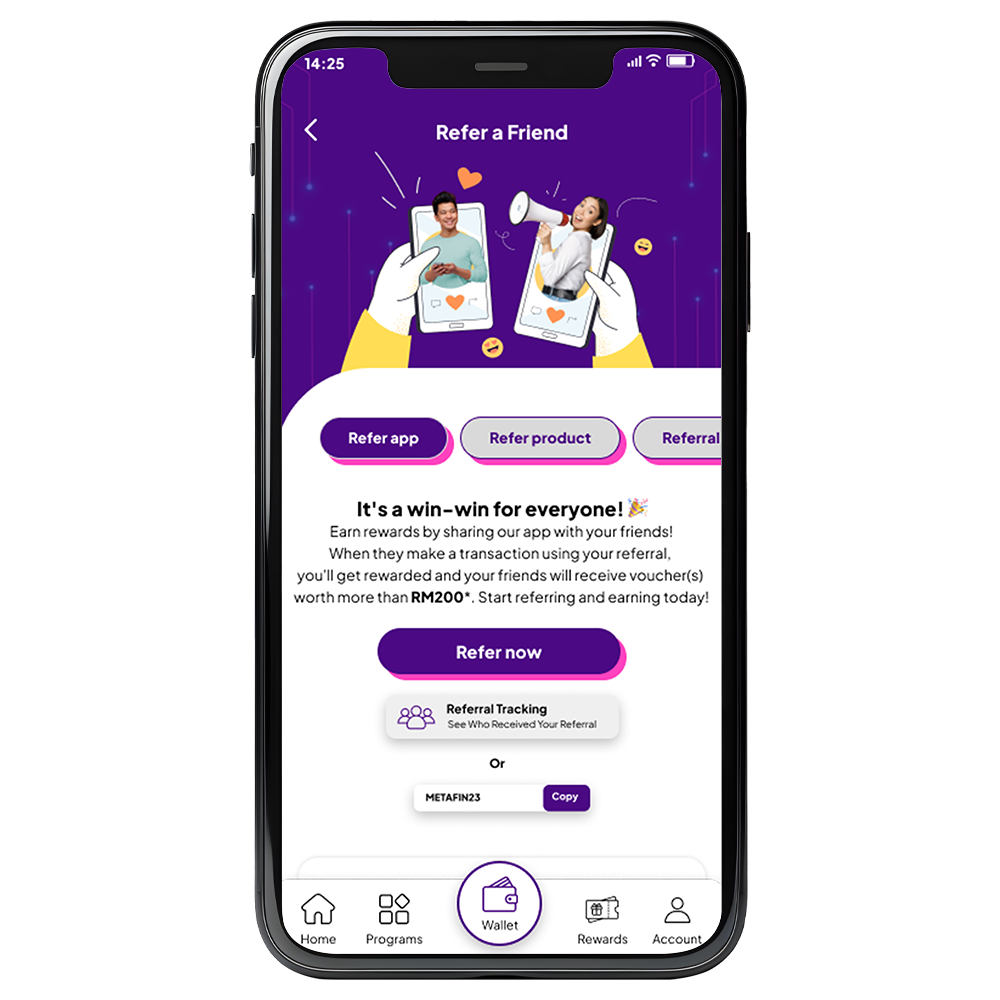

Quick & Easy

Complete your nomination

within 3 Minutes only!

Download & fill in

Nomination Form

Submit original signed copy to Customer Care Unit at

Level 7, A701, Pusat Dagangan Phileo Damansara

II,No.15, Jalan 16/11, Off Jalan Damansara, 46350 Petaling Jaya

Selangor.

Your nomination will be reviewed accordingly and if approved.

Hassle-Free Claims

Submit your claim

easily without worries!

Kindly email qsmedicalclaims@gmail.com to request for the relevant claim form.

Submit the claim form along with the supporting documents to qsmedicalclaims@gmail.com

Your claims will be submitted to the insurer for assessment.

Who Does This Benefit?

- My Legal Spouse & I: Age 19 – 60 years next birthday

- My Children: 30 days old – 19 or 23 years next birthday (full-time student)

- My Families: Who are looking for an affordable investment linked insurance plan

What is Dana Gemilang?

A fund where 80% to 100% of the investments are in equities. This fund seeks to achieve medium to long-term capital appreciation. Although the fund invests mainly in Malaysia (50% to 100%), it may also partially invest in companies that have significant business operations in Singapore (up to 25%) and Greater China (Mainland China, Hong Kong, Macau and Taiwan) (up to 25%), if and when necessary, to enhance the fund’s returns. The fund only invests in Shariah-approved securities.

Source: https://www.greateasternlife.com/content/dam/dmassets/great-eastern/malaysia/gelm-brand-comm/gelm-investment/0724/gelm-others-pi-202406dg.pdfWhat is the potential return?

| End of Policy Year | |||||

|---|---|---|---|---|---|

| Total Contribution | |||||

| Non - Guaranteed | |||||

| Projected Investment Return of Fund: Y% | Projected Investment Return of Fund: X% | ||||

| 5% | 2% | ||||

| Cash Value | Death Benefit | Cash Value | Death Benefit | ||

|

5 |

1,800 |

562 |

30,562 |

524 |

30,524 |

|

10 |

3,600 |

1,216 |

31,216 |

1,057 |

31,057 |

|

15 |

5,400 |

1,979 |

31,979 |

1,599 |

31,599 |

|

20 |

7,200 |

3,032 |

33,032 |

2,306 |

32,306 |

- i) Projected investment return based on basic premium only.

- ii) Dana Gemilang fund is invested in Shariah-approved securities.

- iii) Maturity Benefits projection is not guaranteed. The actual benefits payable will depend on the actual of group performances of the underlying assets of the Unit Funds over time.

IMPORTANT NOTE:

1. The Intermediary Commission amounts to 10% of premium charges while the Service fee amounts to 2% of premium charges.

2. Free-look period - you may terminate the plan by returning the Certificate of Assurance to the Company by hand or registered post within fifteen (15) days after your receipt of the same. If the plan is terminated during this period, the Company shall refund an amount equal to the sum of,

- a. total investment values of the Certificate of Assurance,

- b. the investment values of the units which have been cancelled to pay for insurance charges and policy fees based on Net Asset Value at the Next Valuation Date, and

- c. the amount of premiums that have not been allocated to purchase units;

- d. minus the expenses incurred for medical examination, if any.

Details Breakdown

| Type of Plan (Sum Assured) | PART A: Benefits (RM) | PART B: Monthly Premium (RM) | PART C: *Intermediary's Commission | PART D: *Service Fee | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 45 Covered Event | Death or TPD due to Illness | Death or TPD due to accidental cause (Additional Payment) | Funeral Expenses | Total Investment Value (TIV) | Hospitalisation Benefit (per night stay) | Rate (%) | Monthly Amount (RM) | Rate (%) | Monthly Amount (RM) | ||

|

30,000 |

30,000 |

30,000 |

30,000 |

5,000 |

Based on the Net Asset Value |

30.00 |

30 |

10 |

3.00 |

2 |

0.60 |

NOTES:

Notes: Your plan will terminate upon occurrence of Death or TPD or any one of the 45 Covered Events (except for Angioplasty and other invasive treatments for coronary artery disease) or 100% claim of the sum assured on the Personal Accident Benefit, whichever occurs first.

FAQ

Frequently Asked Questions

References

Important Documents

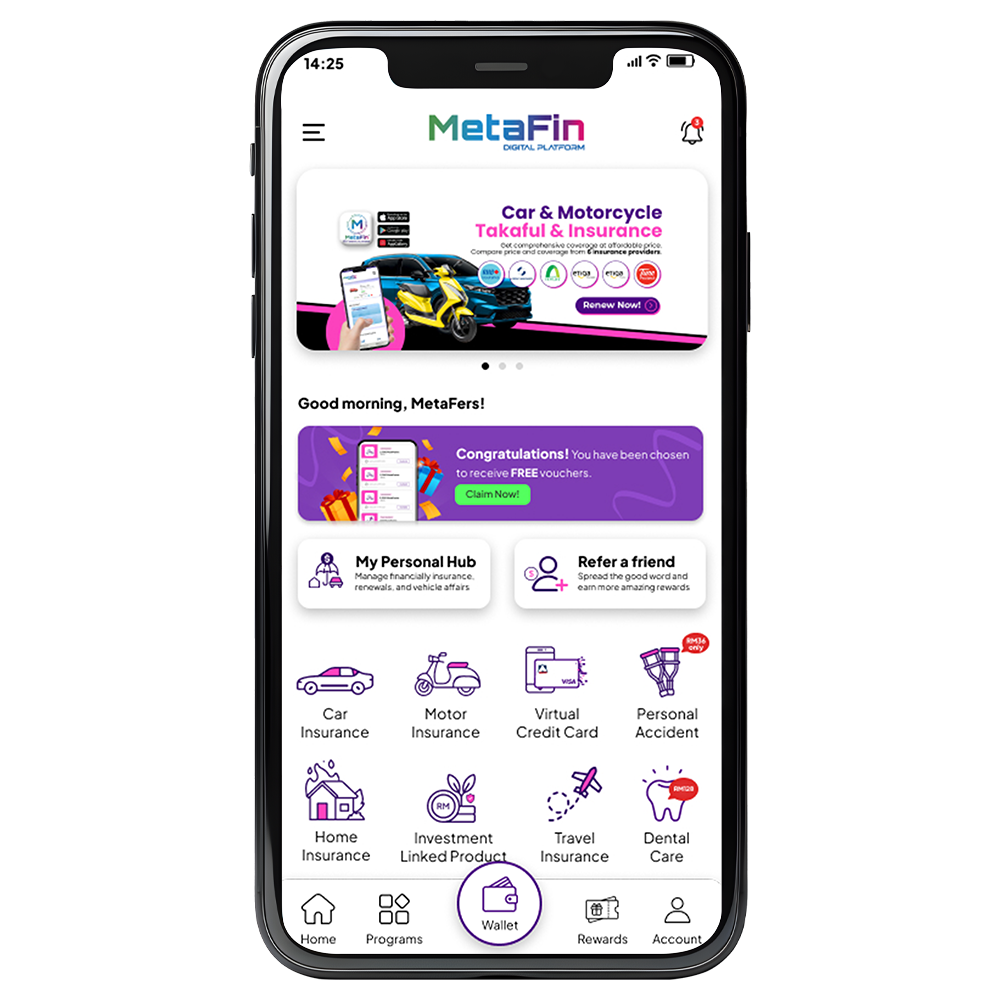

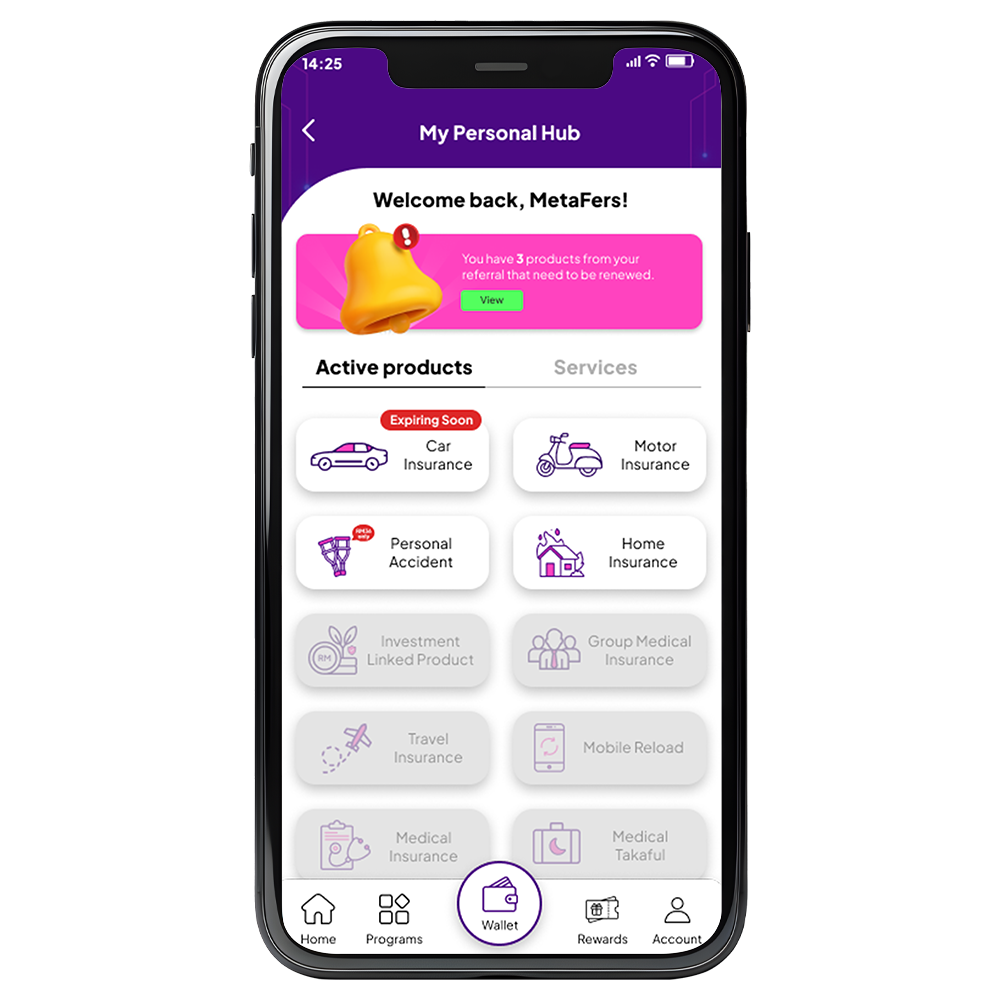

Disclaimer: MetaFin is a neutral digital platform, serving solely as a facilitator and marketplace and not a product provider. MetaFin facilitates listings independently offered by licensed corporate insurance and takaful agencies, and other service providers directly to end users. MetaFin does not endorse, or manage any insurance or takaful products. Each corporate agency is fully responsible for its own product content, compliance, and transactions conducted through the MetaFin platform. Participating agencies must comply with Financial Services Act 2013 (FSA) and/or the Islamic Financial Services Act 2013 (IFSA) by Bank Negara Malaysia (BNM). Great Eastern Life Assurance (Malaysia) Berhad is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Great Eastern Life Assurance (Malaysia) Berhad or PIDM (visit www.pidm.gov.my).