🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

🐴 Gong Xi Fa Cai Deals. Get Up To RM388* OFF

00 Days 00 Hrs 00 Mins 00 Secs Left

Rated by 10,000+ happy drivers

Available Insurers

Tailor Your Plan, Your Way

Pick the benefits that work best for you.

Windscreen & Road Tax Pricing

Malaysia EV Road Tax (Effective from 1 January 2026)

| Minimum Electric Motor(s) Power (W) | Maximum Electric Motor(s) Power (W) | Minimum Yearly Road Tax | Maximum Yearly Road Tax | Rate Increase per 9,999W Block |

|---|---|---|---|---|

| 1 | 100,000 | RM20 | RM70 | RM10 |

| 100,001 | 210,000 | RM80 | RM280 | RM20 |

| 210,001 | 310,000 | RM305 | RM575 | RM30 |

| 310,001 | 410,000 | RM615 | RM1,065 | RM50 |

| 410,001 | 510,000 | RM1,140 | RM2,040 | RM100 |

| 510,001 | 610,000 | RM2,165 | RM3,515 | RM150 |

| 610,001 | 710,000 | RM3,690 | RM5,490 | RM200 |

| 710,001 | 810,000 | RM5,715 | RM7,965 | RM250 |

| 810,001 | 910,000 | RM8,240 | RM10,940 | RM300 |

| 910,001 | 1,010,000 | RM11,265 | RM14,415 | RM350 |

| Over 1,010,001 | - | - | RM20,000 | - |

Follow our TikTok @metafin_official

@metafin_official Explanation Campaign MetaFin 11.11... ♬ original sound - MetaFin DIY Digital Platform

@metafin_official Ramai tak tahu, harga windscreen coverage... ♬ original sound - MetaFin DIY Digital Platform

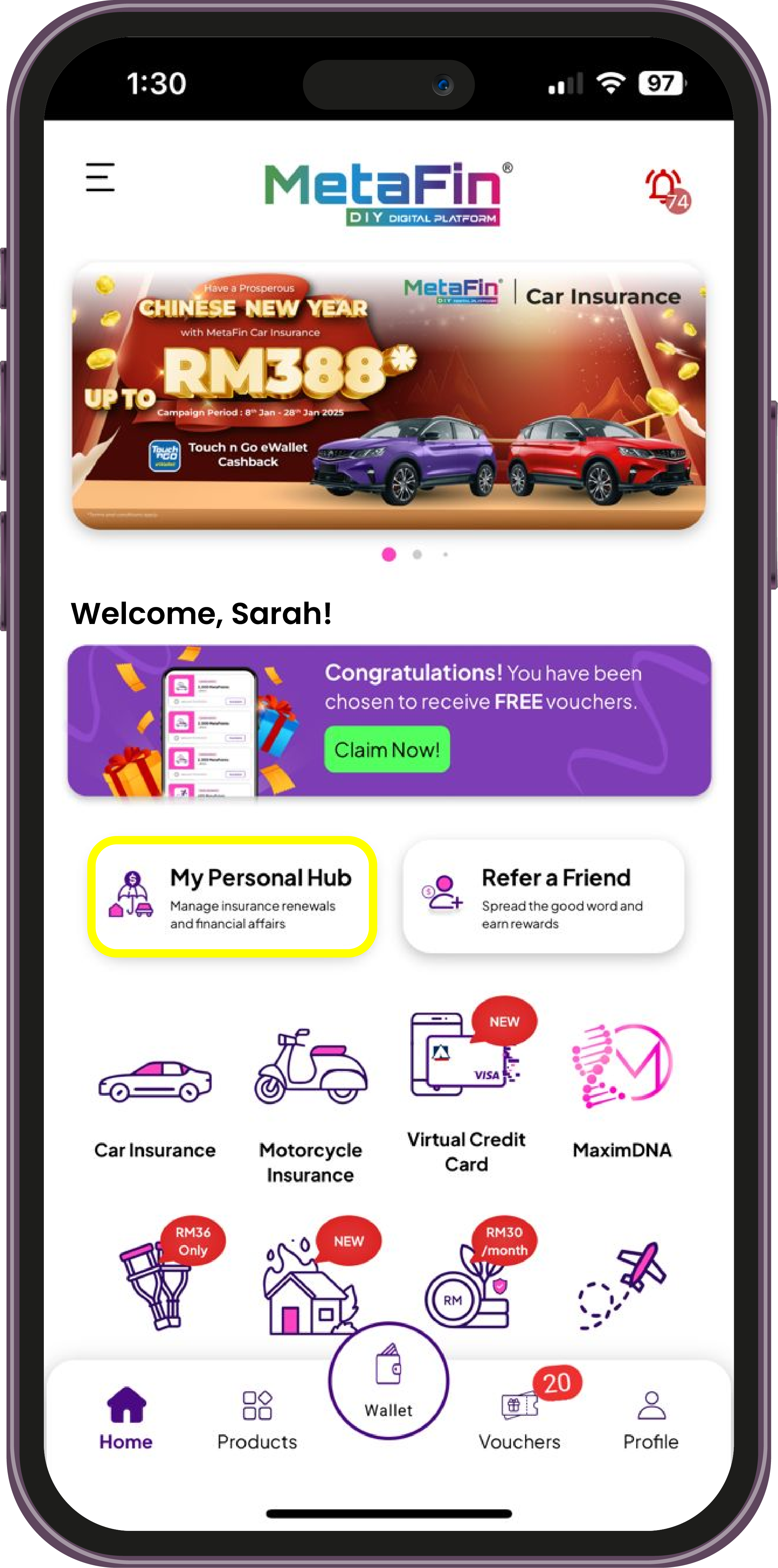

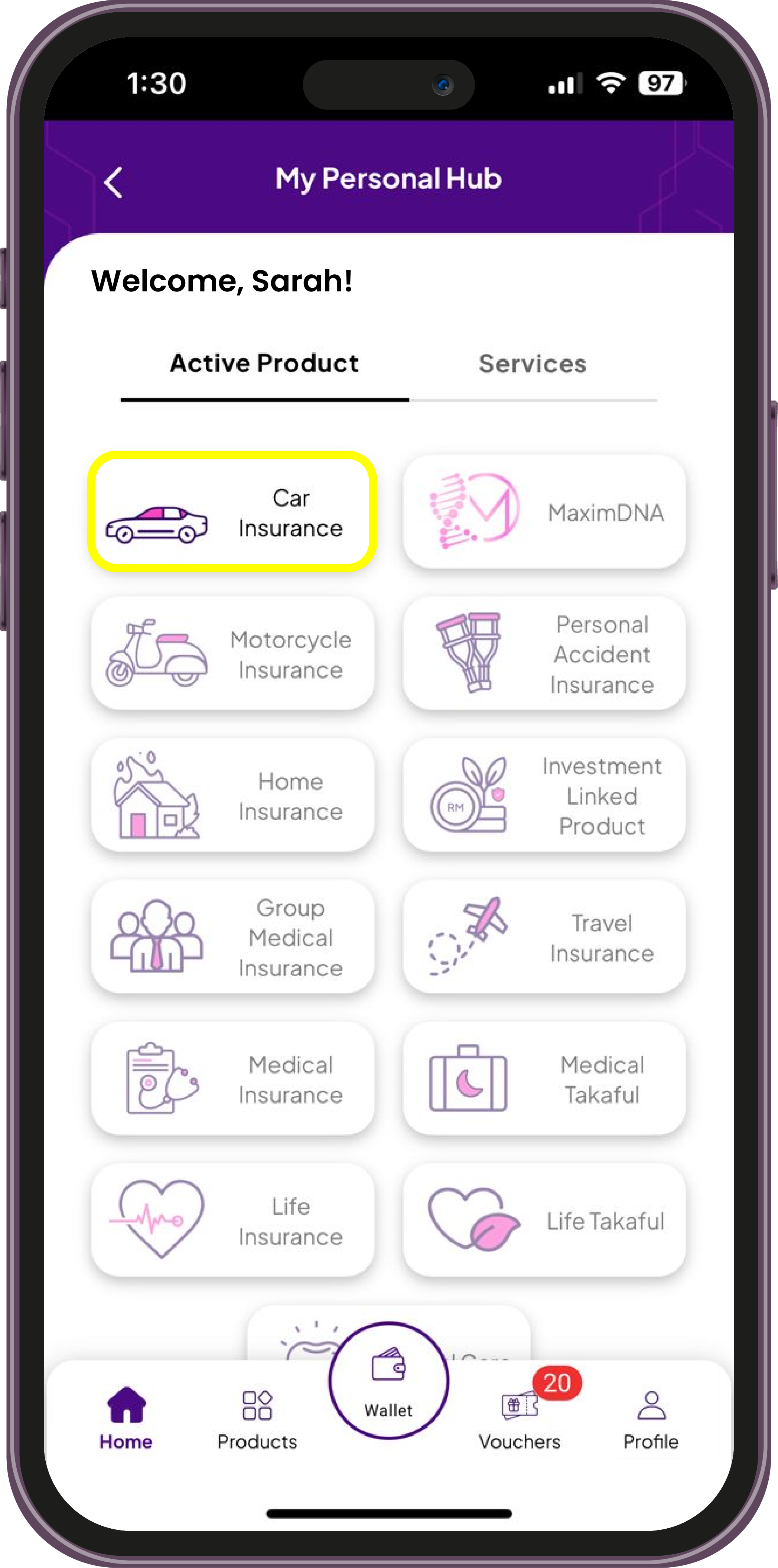

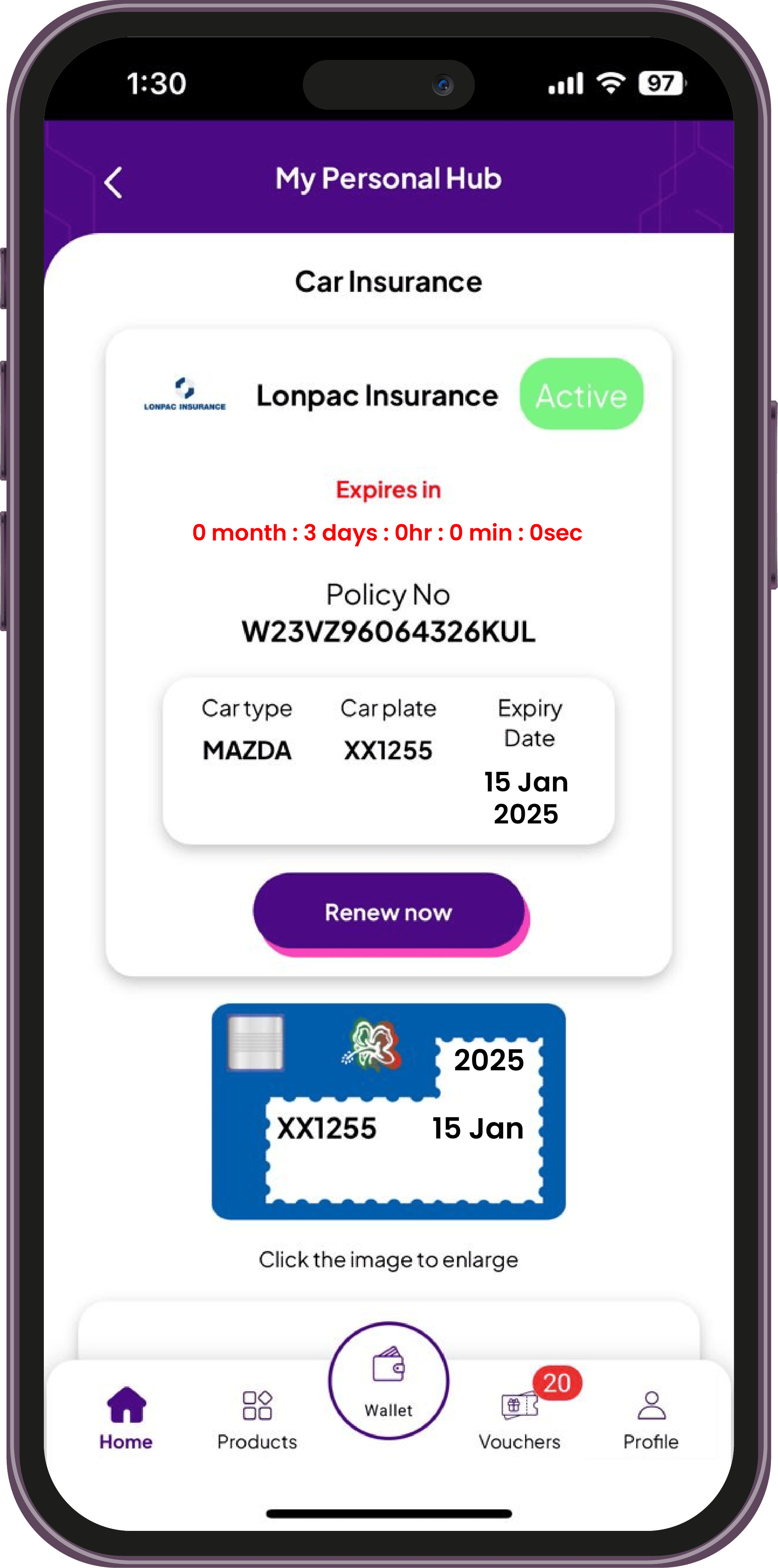

Easy Access to Your Policy

Click the "Car Insurance" button

You can view your policy number, expiry date, and insurer information at a glance.

Engaged Platform Users

MetaFin App Downloads

Monthly Active Users

Insurance & Lifestyle Products

Happy MetaFin Users' Reviews

jra1419

Genuine Review of Metafin App & Services - Truly Impressive! I had a recent medical emergency on 3rd June 2025, where I experienced heavy bleeding and had to rush to Bukit Tinggi Medical Center. After an initial check-up, Dr. Madhulika found that my blood levels were critically low and advised immediate admission...

Farah Hudina Abd Manap

harapan saya program ini berjaya,sangat besar harapan saya bersama MetaFin Sdn.Bhd

Usman Rafique

Nice app recommended my friend I also recommended my friends nd family

Richard Chuah

I insured thru online with metafin for 48 illnesses and has been two years. It was convenience and genuinely trusted company for an insurance coverage. I have done the yearly blood test at Pathlab that was included in my policy. Recommended Metafin for your personal life and medical coverage.

Latest Tips & Trends

Discover expert advice, style inspiration, and product updates on our blog.

Frequently Asked Questions (FAQs)

Everything You Need to Know

The easiest way is to renew your car insurance online through digital platforms like MetaFin App. It allows you to check your premium amounts in 5 mins only. You can also customise your add-ons coverage like windscreen protection, flood cover, all driver, unlimited towing, and many more. No queues, no hassle-do it all from your phone.

You can renew up to 2 months (60 days) before your current insurance expires. Early renewal helps you lock in rates and avoid last-minute penalties or gaps in coverage.

Yes, especially through platforms like MetaFin, where once your insurance is renewed, you can instantly proceed to renew your road tax.

In most cases, yes. Online renewals often come with exclusive promotions, discounts, and cashback offers which usually not available at physical counters. MetaFin, for instance, offers up to RM150 in vouchers.

Comprehensive covers damages to your car and others, while third-party only covers the other vehicle. If your car is under 10 years old, comprehensive is recommended.

Yes, especially if you park outdoors often or travel on highways. Windscreen replacement can cost hundreds or thousands of ringgit. Add-on protection is cheap and saves you the headache later.

Use MyCarInfo to check your NCD. Most digital platforms like MetaFin will also auto-populate this for you during the renewal process.

Even if your car is idle, accidents, theft, or natural disasters can happen. A valid insurance is also required by law to renew road tax.

Popular add-ons include special perils (flood), windscreen, unlimited towing, all-driver coverage, and personal accident. MetaFin lets you customise these add-ons easily.

Yes. Most insurers allow special perils for older cars too, especially if you live in flood-prone areas. It's highly recommended.

Yes. MetaFin supports renewal for company cars and cars under bank loans. Just ensure the vehicle ownership and details are correct.

Your NCD may be reset to 0%, you'll be exposed to liabilities, and you won't be able to renew your road tax. You may also face fines from JPJ.

Takaful follows Islamic principles and profits are shared. Conventional insurance works on risk pooling. Both are valid - MetaFin offers both so you can choose.

Yes. From August 2024, MetaFin offers SpayLater by Shopee, letting you split your payments over a few months and up until 12 months to give flexibility in managing your personal finance.

Instantly. Once payment is made, your policy is generated within minutes and emailed to you.

Review your car's age, value, location (flood risk), daily usage, and whether you need protection for family or company car.

Insured must aged between 17 (after birthdate) up until 85 years only.

Factors include market value of the car, car model, location, NCD, and any add-ons chosen.

If you commute daily, live in flood-prone areas, or park in open lots, consider windscreen and special perils.

Disclaimer: MetaFin is a neutral digital platform, serving solely as a facilitator and marketplace and not a product provider. MetaFin facilitates listings independently offered by licensed corporate insurance and takaful agencies, and other service providers directly to end users. MetaFin does not endorse, or manage any insurance or takaful products. Each corporate agency is fully responsible for its own product content, compliance, and transactions conducted through the MetaFin platform. Participating agencies must comply with Financial Services Act 2013 (FSA) and/or the Islamic Financial Services Act 2013 (IFSA) by Bank Negara Malaysia (BNM). Tune Insurance Malaysia Berhad is a member of PIDM. The benefit(s) payable under eligible product is protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Tune Insurance Malaysia Berhad or PIDM (visit www.pidm.gov.my).

Fill in for a Free Quote!