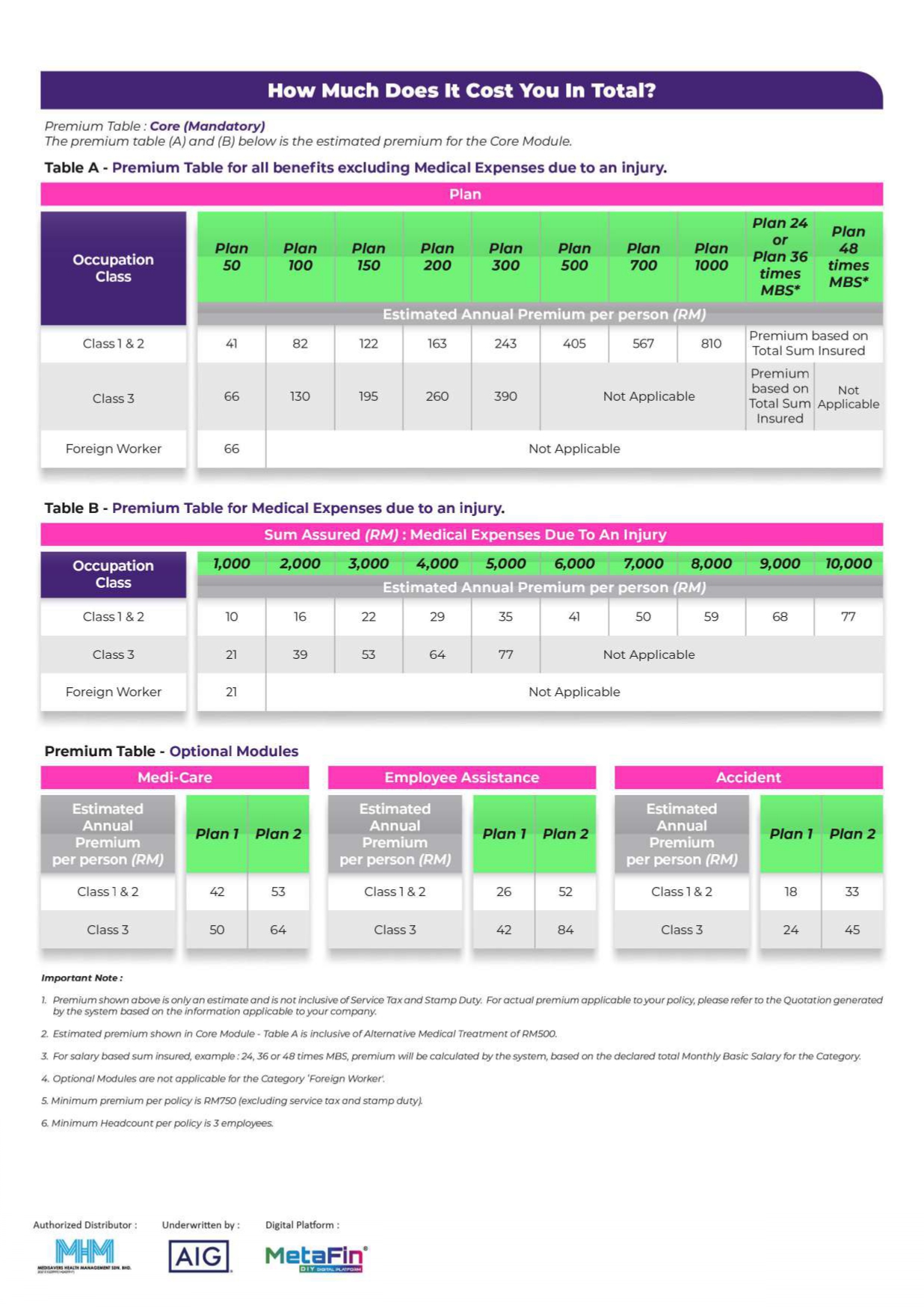

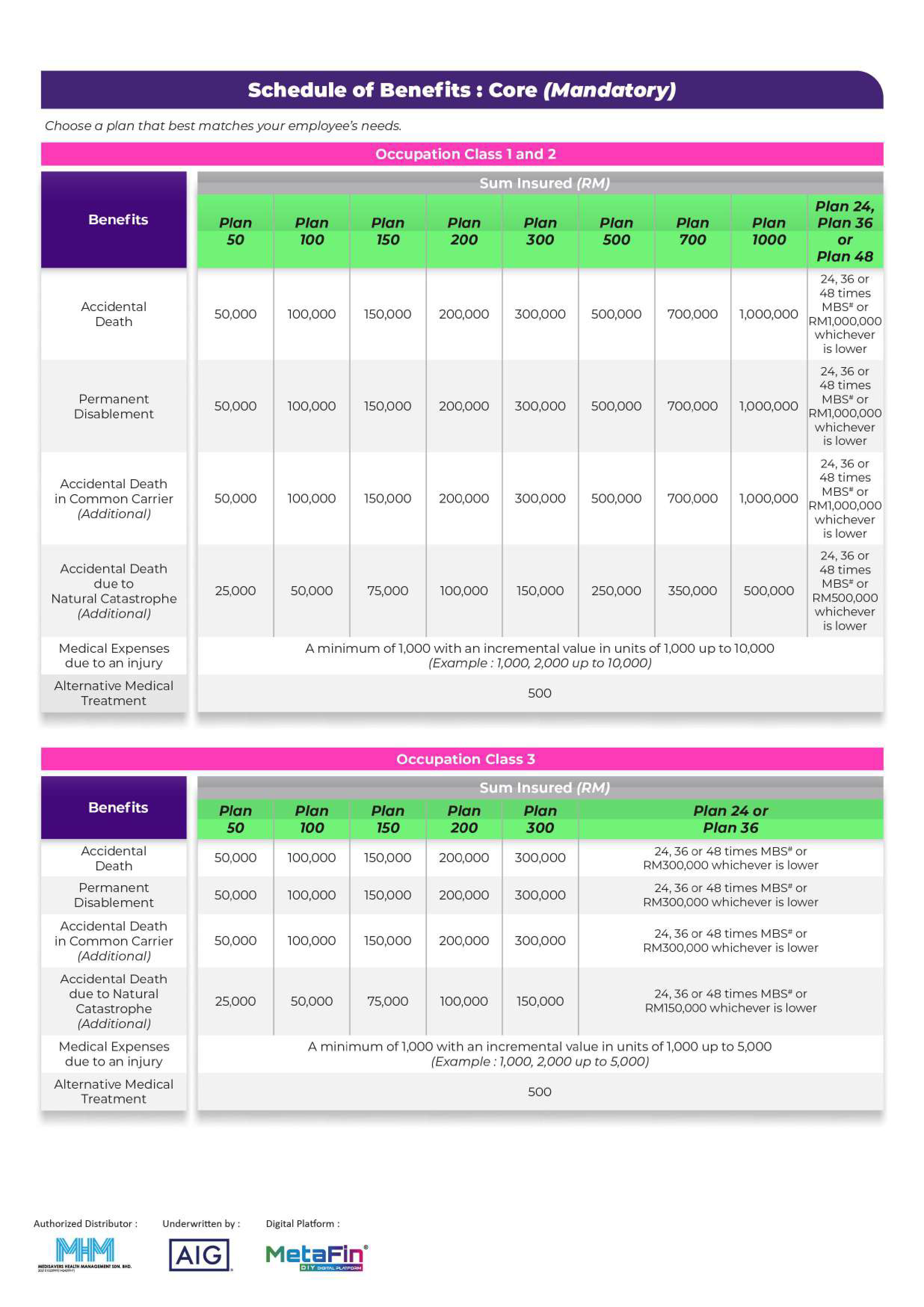

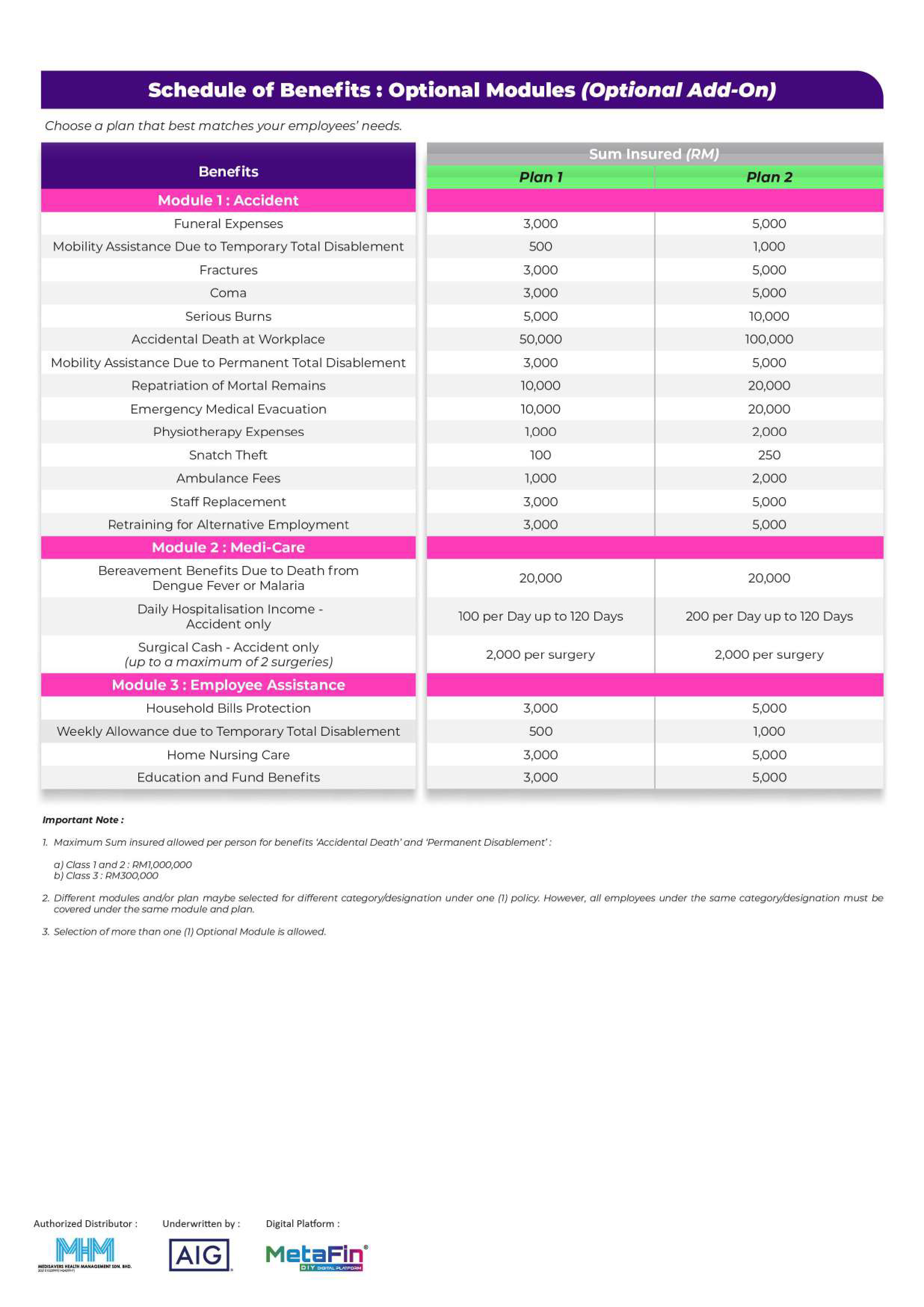

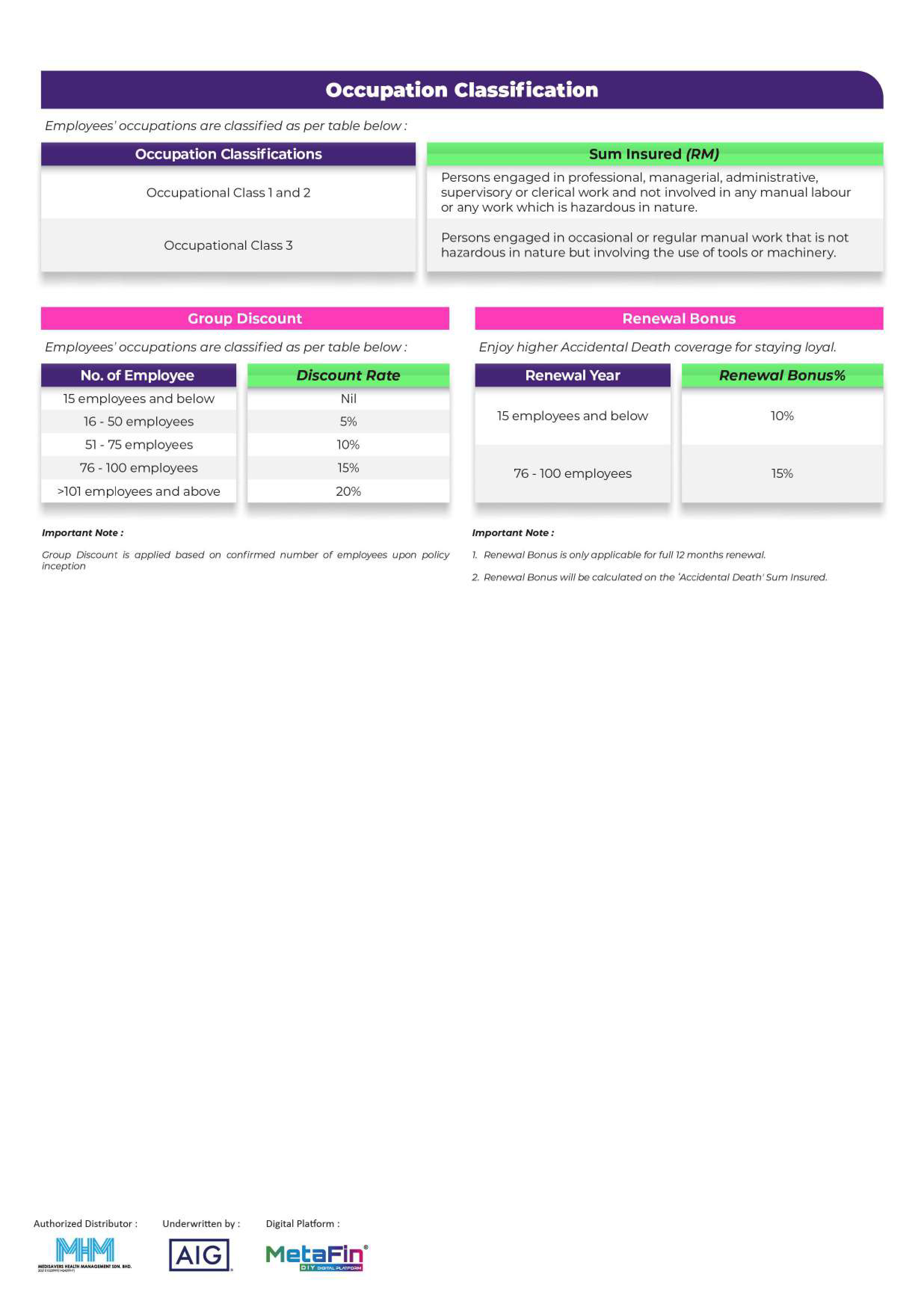

Affordable Group PA Insurance

Starting Monthly As Low As RM41*

Discover The Group PA Insurance

Explore More

More Features to Explore

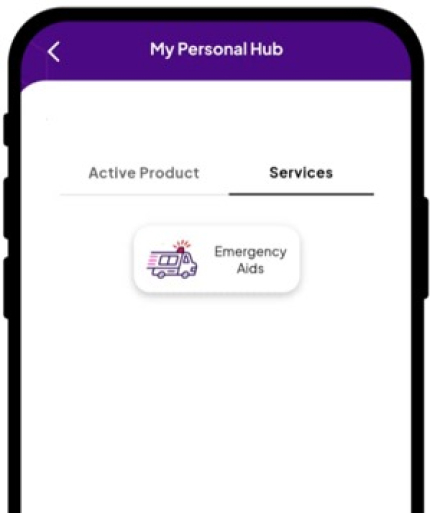

Hassle-Free Claims

Submit your claim

easily without worries!

Download & fill in

Claim Form

Submit the claim form along with the supporting documents to cs@metafin.com.my

Your claims will be submitted to the insurer for assessment.

FAQ

Frequently Asked Questions

References

Important Documents

Disclaimer: MetaFin® users have the option to directly self-sign up for the mSME Solutions Program in the MetaFin Digital Platform. This program is underwritten by AIG Malaysia Berhad, and the enrollment process is facilitated by authorised insurance agency, MediSavers Health Management Sdn. Bhd. The information herein may not fully reflect the context of the product disclosure sheet and full terms of the policy. Please refer to the documents for a detailed description of the product's features and the conditions under which any claims are made. MetaFin® is not liable for misinterpretation of product benefits and claim conditions as described in the policy wording sheet and product disclosure sheet.