LOCAL Hospital Admission Assistance : Allianz Care Services

1-300-88-8322 1

1

Login MyAllianz App

2

2

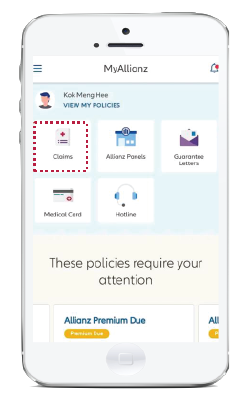

Select “Claims”

3

3

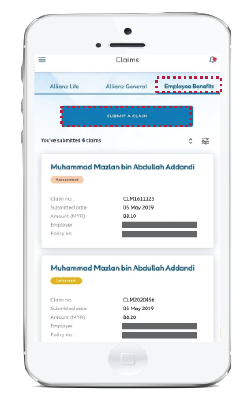

Click on “Employees Benefit” then click “SUBMIT A CLAIM”

4

4

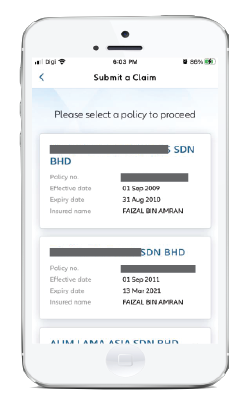

Select policy & fill in claim info.

5

5

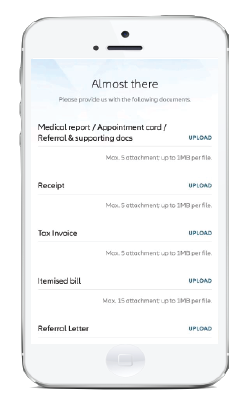

Upload claims photo & submit

Only employees who are:

Premium payment options for the following insurance plans include Group Hospital and Surgical, Death and Disability, and Outpatient Clinical. Please note that only the 'Annual' mode of payment is allowed.

For payment, use the following details:

Account name: ALLIANZ LIFE EMPLOYEE BENEFITS

Bank name: HSBC BANK MALAYSIA BERHAD

Account number: 448500611001

Additionally, for the Add-on program, payments should be made to the Authorized Insurance Agency:

Name: Pathlab Health Management (M) Sdn. Bhd.

Maybank (MBB) account no.: 514 178 430 725

Public Bank (PBB) account no.: 311 966 1229

“Cash Before Cover” is applicable for policies with annual premium of less than RM10,000 excluding stamp duty and service tax. “Cash Before Cover” means that the premiums must be paid before the insurance policy can be issued.

A minimum premium of RM2,000 excluding stamp duty and service tax is required to incept a new policy

The benefits will be paid to whom you have nominated as your beneficiaries. For Total and Permanent Disability claim or Accelerating Critical Illness claim, the benefits will be payable to you.

Yes, the insurance coverage will only continue to remain inforce until the next premium due date and shall cease thereafter.

Yes, if the master policy has been terminated, the insurance coverage will only continue to remain inforce until the next premium due date and shall cease thereafter.

No, reinstatement of a lapsed policy is not allowed. Therefore, it is important that you pay yourpremium on time.

Disclaimer: MetaFin users have the option to directly self-sign up for the Group Medical Insurance in the MetaFin DIY Digital Platform. This program is underwritten by Allianz Malaysia Berhad, and the enrollment process is facilitated by authorized insurance agency MediSavers Management Sdn. Bhd. The information herein may not fully reflect the context of the product disclosure sheet and full terms of the policy. Please refer to the documents for a detailed description of the product's features and the conditions under which any claims are made. MetaFin is not liable for misinterpretation of product benefits and claim conditions as described in the policy wording sheet and product disclosure sheet.