Authorized Distributor:

Underwritten By:

The program offers comprehensive and affordable group personal accident plan to protect small-and-medium enterprises from sudden or unforeseen incidents.

1. New employees can be slotted into any classification declared in the group

.png)

.png)

| Occupation Class 1 and 2 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Sum Insured (RM) | |||||||||

| Benefit | Plan 50 | Plan 100 | Plan 150 | Plan 200 | Plan 300 | Plan 500 | Plan 700 | Plan 1000 | Plan 24, 36 or Plan 48 |

| Accidental Death | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 700,000 | 1,000,000 | 24, 36 or 48 times MBS or RM1,000,000 whichever is lower |

| Permanent Disablement* | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 700,000 | 1,000,000 | 24, 36 or 48 times MBS or RM1,000,000 whichever is lower |

| Accidental Death in Common Carrier (Additional) | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 700,000 | 1,000,000 | 24, 36 or 48 times MBS or RM1,000,000 whichever is lower |

| Accidental Death due to Natural Catastrophe (Additional) | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 700,000 | 1,000,000 | 24, 36 or 48 times MBS or RM500,000 whichever is lower |

| Medical Expenses Due to An Injury | A minimum of RM1,000 with an incremental value in units of RM1,000 up to RM10,000 (Example: 1,000, 2,000, up to 10,000) | ||||||||

| Alternative Medical Treatment | 500 | ||||||||

| Occupation Class 3 | |||||||

|---|---|---|---|---|---|---|---|

| Sum Insured (RM) | |||||||

| Benefit | Plan 50 | Plan 100 | Plan 150 | Plan 200 | Plan 300 | Plan 500 | Plan 24, 36 or Plan 48 |

| Accidental Death | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 24, 36 or 48 times MBS or RM1,000,000 whichever is lower |

| Permanent Disablement* | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 24, 36 or 48 times MBS or RM1,000,000 whichever is lower |

| Accidental Death in Common Carrier (Additional) | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 24, 36 or 48 times MBS or RM1,000,000 whichever is lower |

| Accidental Death due to Natural Catastrophe (Additional) | 50,000 | 100,000 | 150,000 | 200,000 | 300,000 | 500,000 | 24, 36 or 48 times MBS or RM500,000 whichever is lower |

| Medical Expenses Due to An Injury | A minimum of RM1,000 with an incremental value in units of RM1,000 up to RM10,000 (Example: 1,000, 2,000, up to 10,000) | ||||||

| Alternative Medical Treatment | 500 | ||||||

| Sum Insured (RM) | Benefit | Plan 1 | Plan 2 |

|---|---|---|

| Module 1: Accident | ||

| Funeral Expenses | 3,000 | 5,000 |

| Mobility Assistance Due to Temporary Total Disablement | 500 | 1,000 |

| Fractures | 3,000 | 5,000 |

| Coma | 3,000 | 5,000 |

| Serious Burns | 5,000 | 10,000 |

| Accident Death at Workplace | 50,000 | 100,000 |

| Mobility Assistance Due to Permanent Total Disablement | 3,000 | 5,000 |

| Repatriation of Mortal Remains | 10,000 | 20,000 |

| Emergency Medical Evacuation | 10,000 | 20,000 |

| Physiotherapy Expenses | 1,000 | 2,000 |

| Snatch Theft | 100 | 250 |

| Ambulance Fees | 1,000 | 2,000 |

| Staff Replacement | 3,000 | 5,000 |

| Retraining For Alternative Employment | 3,000 | 5,000 |

| Module 2: Medi-Care | ||

| Bereavement Benefit Due to Death From Dengue Fever or Malaria | 20,000 | 20,000 |

| Daily Hospitalisation Income - Accident Only | 100 per Day up to 120 Days | 200 per Day up to 120 Days |

| Surgical Cash - Accident Only (up to maximum 2 surgeries) | 2000 per surgery | 2000 per surgery |

| Module 3: Employee Assistance | ||

| Household Bills Protection | 250 per month up to 3 months | 500 per month up to 3 months |

| Weekly Allowance Due to Temporary Total Disablement | 250 per week up to 52 weeks | 500 per week up to 52 weeks |

| Home Nursing Care | 100 per Day up to 10 Days | 200 per Day up to 10 Days |

| Education Fund Benefit | 5,000 | 5,000 per child up to 10,000 |

| Occupation Classifications | Descriptions |

|---|---|

| Occupation Class 1 & 2 | Persons engaged in professional, managerial, administrative, supervisory or clerical work and not involved in any manual labour or any work which is hazardous in nature. |

| Occupation Class 3 | Persons engaged in occasional or regular manual work that is not hazardous in nature but involving the use of tools or light machinery. |

Enjoy greater savings with group discount

| No Of Employee | Discount Rate |

|---|---|

| 15 employees and below | Nil |

| 16 - 50 employees | 5% |

| 51 - 75 employees | 10% |

| 76 - 100 employees | 15% |

| More than 101 employees | 20% |

Enjoy higher Accidental Death coverage for staying loyal

| Renewal Year | Renewal Bonus % |

|---|---|

|

Year 1-3 |

10% |

|

Year 4 onwards |

20% |

Table A - Premium Table for all Benefit excluding Medical Expenses Due to an Injury.

| Plan (RM) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Occupation Class | Plan 50 | Plan 100 | Plan 150 | Plan 200 | Plan 300 | Plan 500 | Plan 700 | Plan 1000 | Plan 24 or Plan 36 times MBS* | Plan 48 times MBS* |

| Class 1 & 2 | 41 | 82 | 122 | 163 | 243 | 405 | 567 | 810 | Premium based on Total Sum Insured | |

| Class 3 | 66 | 130 | 195 | 260 | 390 | Not applicable | Premium based on Total Sum Insured | Not applicable | ||

| Foreign Worker | 66 | Not applicable | ||||||||

Table B - Premium Table for Medical Expenses Due to an Injury.

| Estimated Annual Premium per person (RM) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Class 1 & 2 | 10 | 16 | 22 | 29 | 35 | 41 | 50 | 59 | 68 | 77 | |

| Class 3 | 21 | 39 | 53 | 64 | 77 | Not applicable | |||||

| Foreign Worker | Not applicable | ||||||||||

| Estimated Annual Premium per person (RM) | ||

| Class 1 & 2 | 18 | 33 |

| Class 3 | 24 | 45 |

| Estimated Annual Premium per person (RM) | ||

| Class 1 & 2 | 42 | 53 |

| Class 3 | 50 | 64 |

| Estimated Annual Premium per person (RM) | ||

| Class 1 & 2 | 26 | 52 |

| Class 3 | 42 | 84 |

Download and fill up the claim form here

Submit the claim form along with the supporting documents to cs@metafin.com.my

Your claim will be reviewed accordingly and if approved.

Premium is paid based on the plan option(s) chosen from the coverage table. The minimum group premium is RM750 (excluding Service Tax and Stamp Duty).

The minimum group size is 3 employees

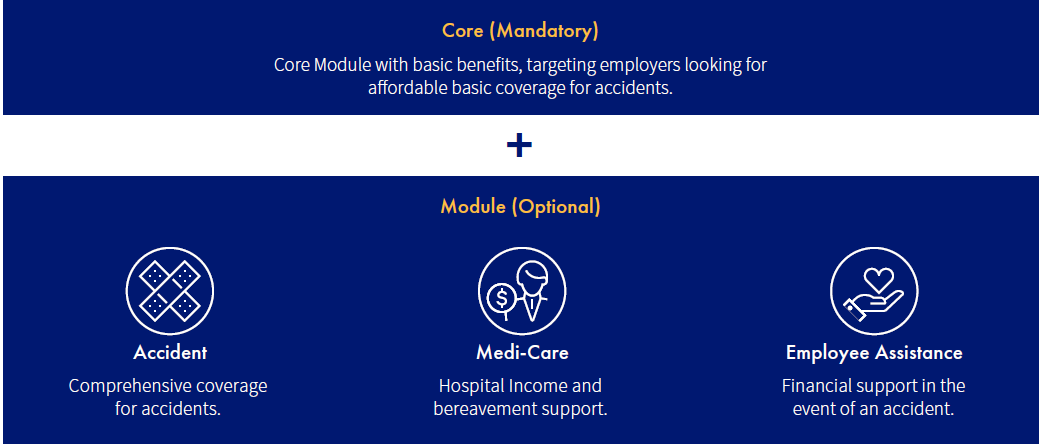

This product has 1 mandatory Core Module and 3 Optional Modules as follows. Each Optional Module has 2 Plans.

Each employee must be between 18 to 75 years of age to qualify.

This is based on the number of employees declared to the company under the classification of occupation class stated in the schedule. New employees will be automatically covered subject to:

i) Categories where the occupation has changed from occupations declared at the inception of the Policy; or

ii) any Category or inclusions from any new acquisition or subsidiary where the nature of business differs from the declared nature of business of the Policyholder; or

iii) any increase in the total number of employees by more than 20% or 5 persons (whichever higher) of the current headcount

If the number of employees is more than the number of employees declared in the classification of occupation class stated in the schedule, the company shall not be liable to pay or contribute more than its rationable proportion of any loss. Otherwise, this is subject to the terms and conditions of the policy.

This policy is arrange on a headcount basis. The declaration must include the employee’s designation and the plan he/she is covered for.

Occupation Class 1 and 2 – Persons engaged in professional, managerial, administrative, supervisory or clerical work and not involved in any manual labour or any work which is hazardous in nature.

Occupation Class 3 – Persons engaged in occasional or regular manual work that is not hazardous in nature but involving the use of tools or light machinery.

An employer may cancel the policy at any time by providing a 30 days written notice. The employer will be entitled to a refund of the premium on a prorate basis for the unexpired period of insurance.

Fill in your details to get a free quote and we will contact with you soon!