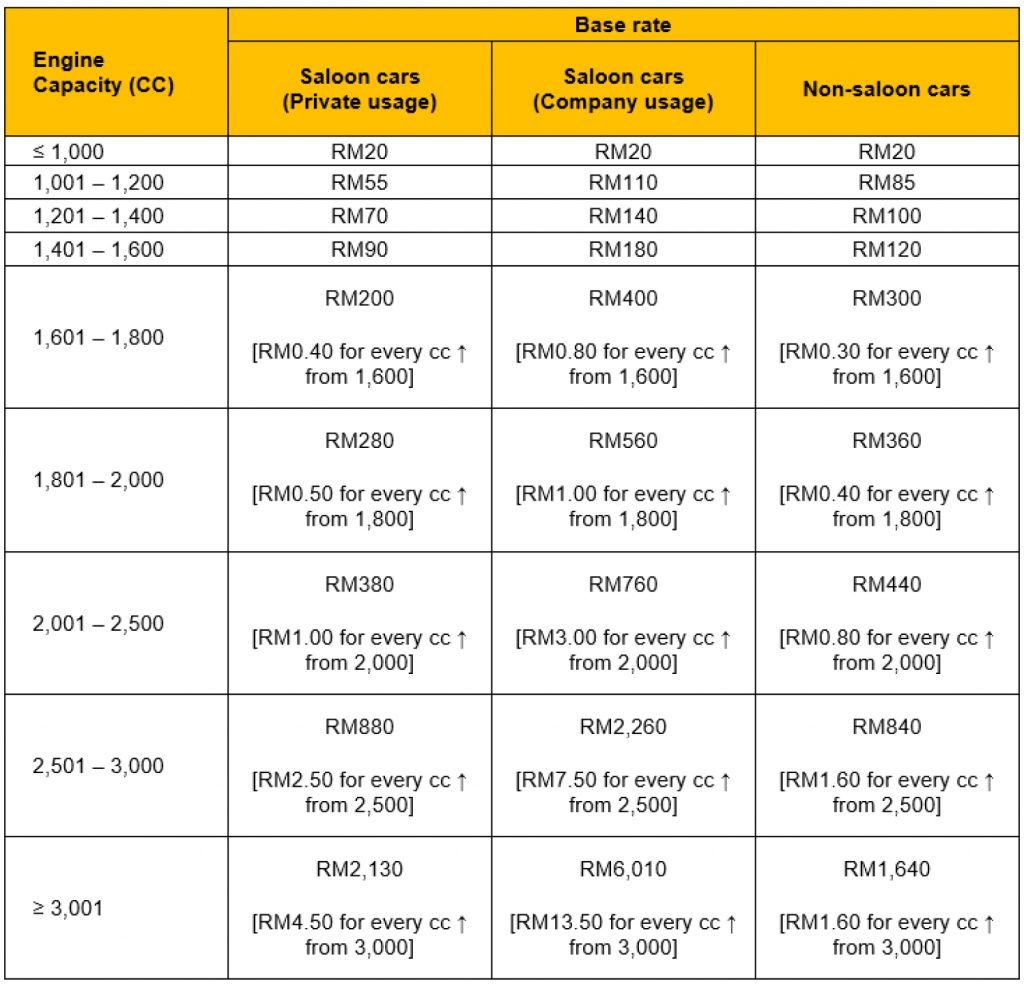

All prices displayed below are JPJ’s base rate for vehicles in Peninsular Malaysia.

Note:

As our service provider is based in Peninsular Malaysia, all road tax renewals will be based on West Malaysia’s pricing.

Table 1: Comparison of Car Engine Capacity with the Road Tax Base Rates

Example:

For Saloon Car with 1,996cc (private usage)

Base rate: RM280 [for 1,801 – 2,000cc range]

Progressive rate:

1,996cc – 1,800cc = 196cc

196cc x RM0.50 = RM98

Total road tax amount = Base rate + Progressive rate = RM280 + RM98 = RM378

Table 2: Comparison of Motorcycle Engine Capacity with the Road Tax Base Rates

Special for all MetaFin users:

Secure a unique protection for yourself and your loved ones.