Car insurance is compulsory in Malaysia. Yet, many drivers still do not fully understand what their policy covers. Often, the truth only becomes clear after an accident happens. By then, fixing mistakes can be stressful and expensive.

This article explains important car insurance facts that insurers do not always highlight. More importantly, it helps Malaysian drivers make informed decisions before buying or renewing their coverage.

Why Car Insurance Often Confuses Drivers

Car insurance documents use legal and technical terms. Because of this, many drivers feel overwhelmed when reading them. As a result, they focus mainly on price instead of coverage.

At the same time, renewals often happen quickly. Discounts may be highlighted, while exclusions or limits receive less attention. Therefore, misunderstandings are common.

Knowing what to check early helps drivers avoid costly surprises later.

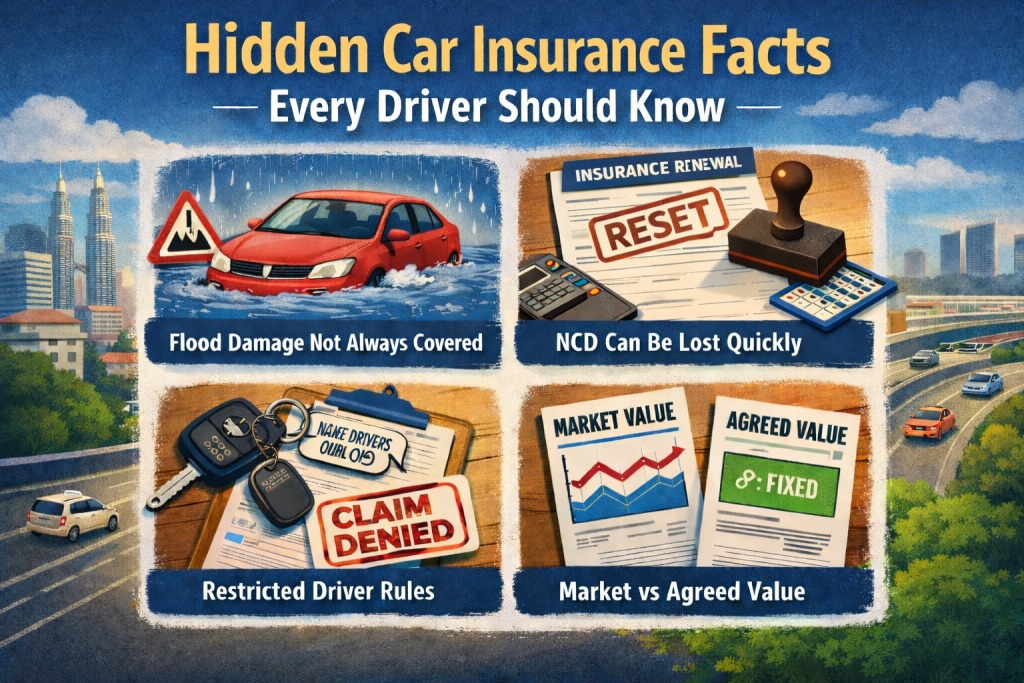

Comprehensive Insurance Is Not Always “Full” Coverage

Many drivers assume comprehensive insurance covers everything. In reality, coverage differs between insurers and policy types.

Most comprehensive policies include:

- Third-party injury or death

- Third-party property damage

- Damage to your own car

- Fire and theft

However, exclusions still apply. For example, flood damage is usually not included by default. Windscreen coverage often requires an additional add-on.

Because of this, reading the policy schedule is essential.

Flood Damage Usually Requires an Add-On

Flooding affects many parts of Malaysia every year. Despite this, insurers usually classify flood damage as a special peril.

Without this add-on:

- Flood-related claims are usually not payable

- Engine damage caused by water ingress may not be covered

Bank Negara Malaysia requires insurers to clearly disclose special peril coverage in policy documents (Source: Bank Negara Malaysia – https://www.bnm.gov.my).

Drivers who live or work in flood-prone areas should strongly consider this protection.

Your No Claim Discount (NCD) Can Be Lost Easily

The No Claim Discount (NCD) rewards drivers who do not make claims. Over time, it reduces insurance premiums. However, many drivers do not realise how easily it can be affected.

In general:

- Making an own-damage claim resets NCD

- Certain third-party claims may still affect NCD, depending on circumstances

- Errors during policy transfer can cause NCD loss

Insurance Services Malaysia (ISM) manages NCD records nationwide (Source: https://www.myism.com.my).

Before renewing, drivers should always confirm their NCD status.

Driver Restrictions Can Affect Claims

Insurance policies clearly state who is allowed to drive the car. Unfortunately, this section is often overlooked.

Policies may include:

- Named-driver requirements

- Age limits

- Valid licence conditions

If an unauthorised or unlicensed driver is involved in an accident, insurers may reduce or reject own-damage claims. Therefore, confirming driver eligibility early is important.

Market Value Determines Your Claim Payout

Most car insurance policies in Malaysia insure vehicles at market value. This value decreases each year as the car ages.

As a result:

- Older cars receive lower payouts after total loss

- Owners may feel undercompensated

Some insurers offer agreed value options. These fix the payout amount in advance. However, premiums are usually higher.

Understanding this difference helps manage expectations before a claim occurs.

Accident Reporting Is Mandatory

Many drivers believe small accidents do not need reporting. In reality, Malaysian insurers require all accidents to be reported.

According to Persatuan Insurans Am Malaysia (PIAM):

- Accidents must be reported within 24 hours

- Private settlements still require reporting

Failure to report can affect claim eligibility (Source: https://piam.org.my).

To stay protected, drivers should report every accident, regardless of severity.

Add-Ons Often Provide Better Real-World Protection

Some drivers skip add-ons to save money. However, add-ons often cover real risks faced on Malaysian roads.

Common add-ons include:

- Flood and natural disaster cover

- Windscreen protection

- Passenger liability

- All-driver coverage

Choosing the right add-ons strengthens overall protection without a large increase in premium.

What Car Insurance Does Not Cover

Car insurance does not cover every situation. Understanding exclusions helps avoid disappointment.

Common exclusions include:

- Driving under the influence of alcohol or drugs

- Illegal activities

- Mechanical breakdowns

- Normal wear and tear

- Driving without a valid licence

Because of these exclusions, claims may be denied even if the policy is active.

Cheapest Insurance Is Not Always the Best Choice

Low premiums can be attractive. However, cheaper policies often come with trade-offs.

These may include:

- Higher excess payments

- Limited panel workshops

- Slower claim processing

Instead of choosing based on price alone, drivers should compare coverage, service quality, and claims support.

Compare Car Insurance Online for Better Transparency

Today, Malaysian drivers can compare insurance policies online. This approach improves clarity and saves time.

Digital platforms allow drivers to:

- Compare multiple insurers

- Review coverage differences clearly

- Select suitable add-ons

For example, MetaFin helps drivers explore car insurance options in one place:

👉 https://metafin.com.my/car-insurance-online.php?src=blog

This transparency empowers drivers to make better decisions.

Common Car Insurance Myths in Malaysia

| Myth | Reality |

|---|---|

| Comprehensive means full cover | Add-ons may still be required |

| Cheapest policy is best | Coverage matters more |

| Small accidents need no report | Reporting is mandatory |

| NCD lasts forever | Claims can reset it |

Understanding these myths helps prevent costly mistakes.

Final Thoughts: Be an Informed Insurance Buyer

Car insurance is more than a legal requirement. It is financial protection.

When drivers understand their policy:

- Claims become smoother

- Disputes are reduced

- Coverage gaps are avoided

By reading policy details, asking questions, and comparing options, Malaysian drivers can protect themselves better. Being informed today helps prevent problems tomorrow.

Compliance Disclaimer

This article is for general informational purposes only and does not constitute insurance or financial advice. Coverage, terms, and conditions vary by insurer. Always refer to official policy documents or consult a licensed insurance intermediary before making decisions.