When it comes to employee retention and satisfaction, company stakeholders understand that offering a comprehensive Employee Benefits plan can be a game-changer in avoiding the brain drain.

Employee Benefits refer to a range of perks and protections offered by businesses to support their workforce. These benefits can include medical coverage, life coverage, dental care, mental health support, and professional development programs, all of which help reduce turnover and increase employee loyalty.

But let’s narrow down Employee Benefits to Group Medical Insurance. With so many insurance providers available, navigating the landscape can be overwhelming for stakeholders trying to secure the best coverage at a competitive price.

So, what should Bosses and HR professionals look for when selecting a group medical insurance package? Here’s how the MetaFin Digital Platform assists your company.

Key Terminology You Should Know

Understanding the fundamentals of SME Group Medical Insurance will make it easier to evaluate different plans and select one that best suits your company’s needs. Below are some essential terms you’ll come across:

1. Group Hospitalisation & Surgical (GHS)

A fundamental part of SME Group Insurance is the medical insurance plan, known as Group Hospitalisation & Surgical (GHS) which covers hospitalization costs, surgical expenses, and related medical services for employees.

Important aspects to note:

- Waiting Period – The duration an employee must wait before certain hospitalization benefits become accessible. This period is typically 120 days, depending on the policy. However, treatment for accidents is covered immediately.

- Room & Board – This refers to the daily cost of a hospital room covered under the insurance plan, which is a key factor in determining the premium price of a Group Hospitalisation & Surgical (GHS) plan. Companies can customize coverage based on employee position levels.

- Annual Limit – The maximum coverage an employee can claim per year under the policy. For Group Hospitalisation & Surgical (GHS) plans, limits typically start from RM20,000 and above, depending on the coverage level. Employers can adjust limits based on employee hierarchy to balance protection and cost.

2. Group Outpatient Clinical (GOPC)

This benefit covers clinic visits for common illnesses, general practitioner (GP) consultations, and an overall unlimited lifetime limit for panel clinics.

3. Group Term Life (GTL)

A life insurance policy that provides financial security to employees and their dependents. This plan provides coverage for death, total or partial disabilities, and even terminal illnesses. Be sure to consider optional riders, such as adding coverage for critical illnesses for enhanced protection.

Final Thoughts

Investing in Group Medical Insurance is not just about compliance—it’s about creating a supportive work environment where employees feel valued and protected. As an SME, striking a balance between affordability and comprehensive coverage is key to fostering employee well-being and business growth.

At MetaFin, we’re here to help you navigate the complexities of Employee Benefits. Whether you’re just starting out or looking to enhance your existing package, our team can provide tailored solutions that align with your business goals.

Click the link to get a quote:

https://bit.ly/DIY_EmployeeBenefits_Quotation

Got Questions? Email us: sme@metafin.com.my

Group Hospitalisation and Surgical (underwritten by Allianz, facilitated by an authorized insurance agency, MediSavers Management Sdn. Bhd.)

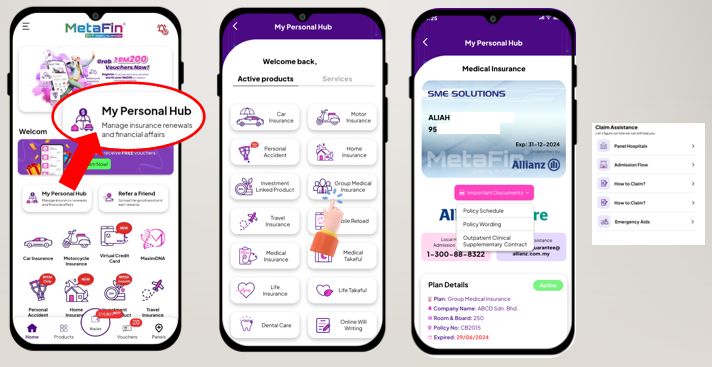

Upon signing up, each of the employees will have their own personal hub on our MetaFin Digital Platform with extensive information available such as panel hospitals, admission flow and more.