Fundamentally, group medical insurance is a single policy, usually sponsored by a business, that offers health care to the employees. Group medical insurance is a more affordable and comprehensive option than individual health plans since it provides all qualified members with benefits under one roof. This method guarantees access to high-quality healthcare while doing away with the need for distinct rules and streamlining administration.

Group medical insurance plays a pivotal role in ensuring the well-being of employees by offering comprehensive healthcare coverage to a predefined group, such as the workforce of a company or members of an organization. This type of insurance is not only a financial safeguard but also a crucial component of employee benefits that fosters security, loyalty, and productivity. In this blog post, we will explore more about Group Medical Insurance and the importance of having these employee benefits for your team.

1. Comprehensive Coverage:

Group medical insurance typically includes hospitalisation, outpatient treatments, diagnostic tests, and sometimes preventive care. Coverage plans available on MetaFin Digital Platform includes basic coverage like Group Hospitalisation and Surgical (underwritten by Allianz, facilitated by an authorized insurance agency, MediSavers Management Sdn. Bhd.) with the option to add on other plans such as Group Term Life, Group Outpatient Clinical and more. By enrolling to these employee benefits, it would help employees avoid financial hardship due to medical expenses and can improve their quality of life by providing access to necessary medical treatments.

2. Retention:

A strong group medical insurance policy is a crucial perk that increases an organisation’s appeal to potential workers and retains existing employees. Employees are more likely to stay with an employer that offers solid benefits. Offering insurance benefits contributes to employee loyalty and can reduce turnover, saving the company costs associated with hiring and training new employees.

3. Cost Effective:

Financial planning is often aided by benefits like group term life and group personal accident insurance. Although hospitalisation and surgery expenses are partially covered by a group medical coverage, these extra benefits offer vital financial support if an employee becomes partially or permanently disabled due to a terminal illness or unanticipated accidents. A lump sum payment in these situations might lessen the financial strain and provide the worker and their family peace of mind of financial issue.

In summary, group medical insurance provides a win-win situation for both businesses and employees. Besides, it fosters a healthier workforce, increases employee loyalty, and offers financial safety. Furthermore, in today’s cutthroat employment market, it continues to be one of the most valued employee benefits despite some challenges. To keep this crucial benefit available and updated, employers need constantly modify their group insurance plans to accommodate the changing needs of their employees.

Your benefits, your way! Find out more about group medical insurance and get FREE quote available to you only on MetaFin Digital Platform. Got Questions? Feel free to email them to sme@metafin.com.my. Please do not hesitate to contact us if you have any questions or require further information. We are here to make the process as seamless as possible your company.

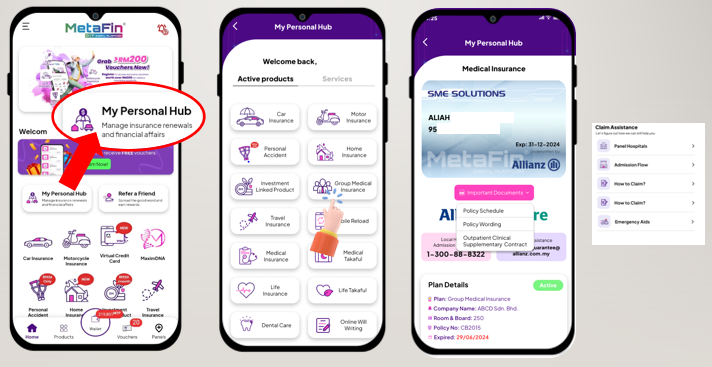

Upon signing up, each of the employees will have their own personal hub on our MetaFin Digital Platform with extensive information available such as panel hospitals, admission flow and more.