Ensuring adequate insurance coverage is a crucial aspect of responsible vehicle ownership. In Malaysia, there is the requisite comprehensive car insurance for vehicles with ages below 10, then there is the basic insurance coverage, also known as third-party insurance policy, eligible for vehicles aged 15 years and above.

Understanding the minimal insurance requirements is essential not only for owners of old vehicles but also for every driver so that they are aware of the coverages afforded to them depending on the age of their car.

Furthermore, according to the Road Transport Act 1987, it is compulsory for every vehicle owner to own the most basic insurance cover which is the third-party cover, a basic premium which only insures non-passengers afflicted in an accident.

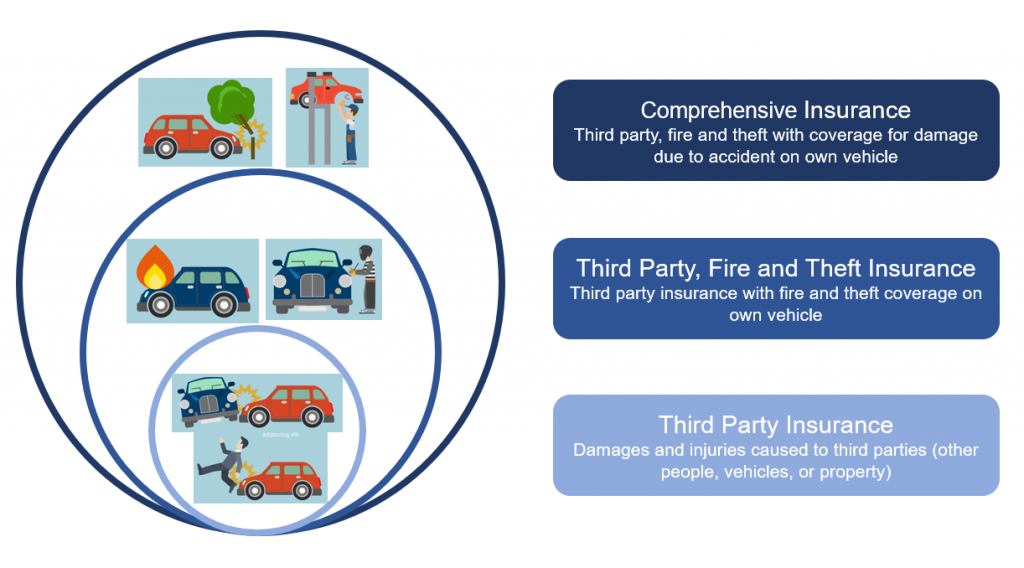

Third Party Insurance:

This type of insurance covers damages and injuries caused to third parties (other people, vehicles, or property).

As mentioned above, vehicles of age 15 years and above are only qualified for this coverage.

The downside of this policy is your insurance will only compensate the third party. This means in any case whether you are at fault or not at fault of the accident, you have to bear the repair costs towards your vehicle, insurers just won’t allow you to make a claim for an old car.

Third Party, Fire and Theft Insurance:

Some providers might allow owners of aged cars to a third-party, fire and theft cover. The risks covered under this policy are damages to third-party’s property, death or injury to third-party, and fire and theft coverage on own vehicle. However, it’s important to note that damages to your own vehicle are typically not covered under this policy.

Comprehensive Insurance:

As the cover policy suggests, this insurance plan provides extensive coverage for various risks, including damage to your vehicle from accidents, theft, fire as well as damages and injuries caused to third parties (other people, vehicles or property). Due to its wider coverage, comprehensive car insurance has a higher premium price compared to the other two policies.

In conclusion, understanding the nuances of car insurance coverage is vital for all drivers in Malaysia. Whether you own a newer vehicle eligible for comprehensive insurance or an older vehicle qualifying for basic coverage, being aware of your insurance options is essential for responsible vehicle ownership.

For vehicles aged below 10 years, comprehensive car insurance provides extensive coverage, offering protection against various risks. On the other hand, vehicles aged 15 years and above are typically eligible for basic insurance coverage, commonly referred to as third-party insurance.

Ultimately, by understanding the minimal insurance requirements and exploring available coverage options, drivers can make informed decisions to ensure adequate protection for themselves and their vehicles.

Explore our digital platform, MetaFin, and get a free quote for either your car or motorcycle!