Experience seamless benefits management with

MetaFin DIY Digital Platform

HR Paperless processes

Personal Product Tracker Hub

Hassle-free access to multiple coverage providers

Unlock MetaPoint rewards with exclusive coverage redemption

RM200 is yours!

when you download the MetaFin Digital app and register to collect up to 20,000 MetaPoints voucher today!

A better journey for accessing experiences

Hospital Admission Assistance Chatbot Button by In-House Doctors

The eCard functionality is available within the MetaFin DIY Digital App

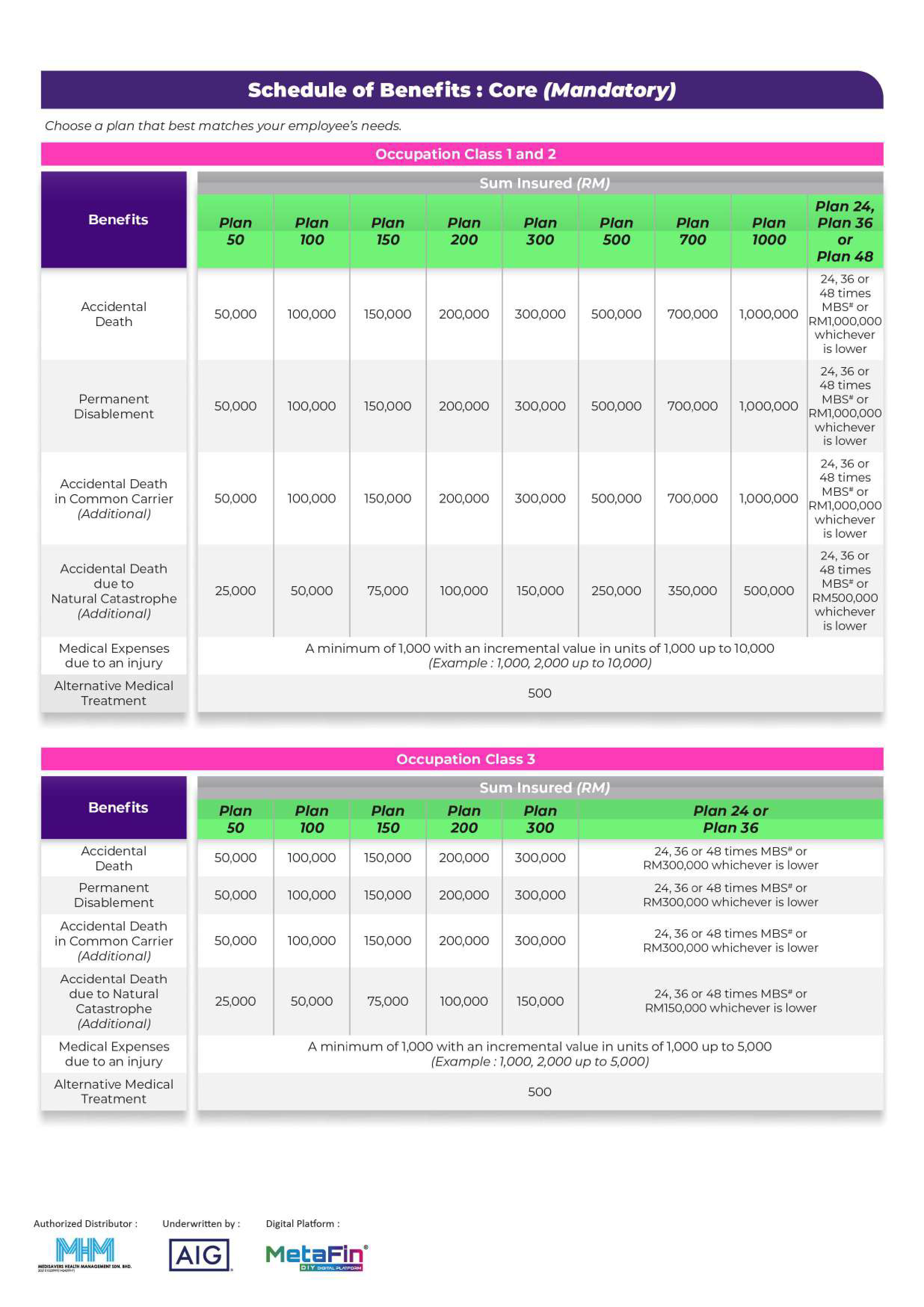

Discover The Group PA Insurance

Easy Entry Min 3 Staff & above

Up to RM1,000,000 sum insured for Accidental Death and Permanent Disablement

50% for Permanent Total Disablement

24/7 Comprehensive Coverage for accidents

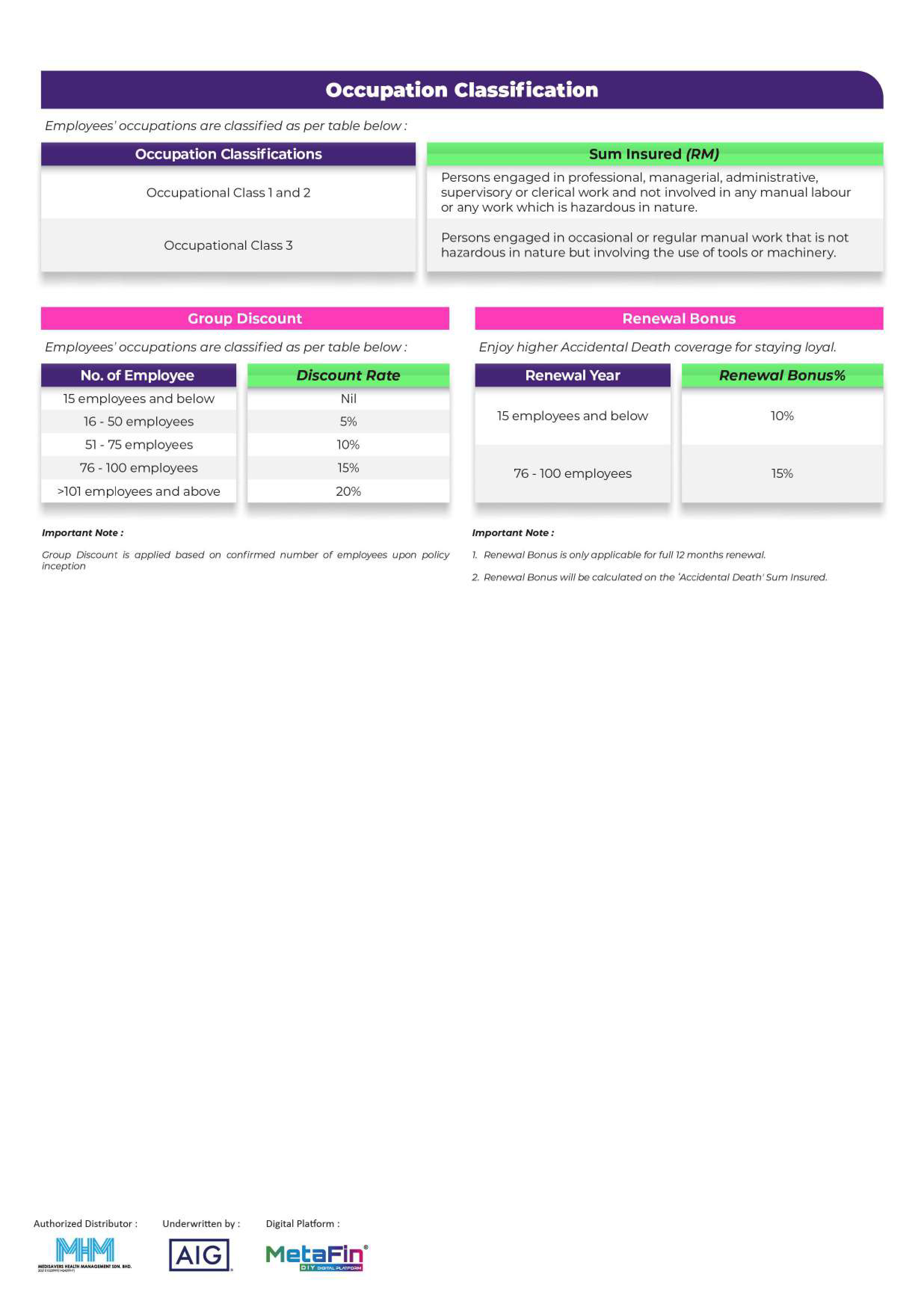

Enjoy up to 20% on Group Discount

Customisable to you and your company’s needs (including optional modules)

No Medical Underwriting

Cover employees on unnamed basis declared by occupation class

MetaFin Users' Reviews: Experiences and Testimonials

How to Claim?

Download and fill up the claim form here

Submit the claim form along with the supporting documents to cs@metafin.com.my

Your claim will be reviewed accordingly and if approved.

Frequently Asked Questions

-

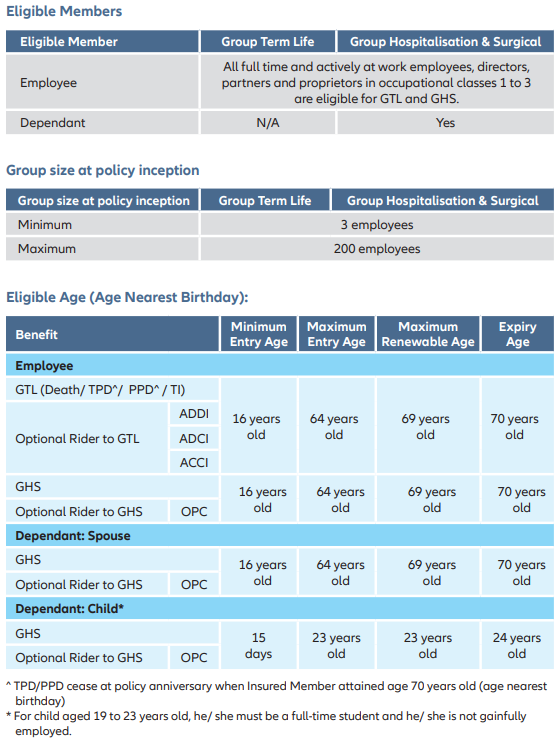

Who is eligible for coverage ?

-

What is the minimum requirement for group size to apply?

The minimum group size is 3 employees

-

How many Modules does this product have?

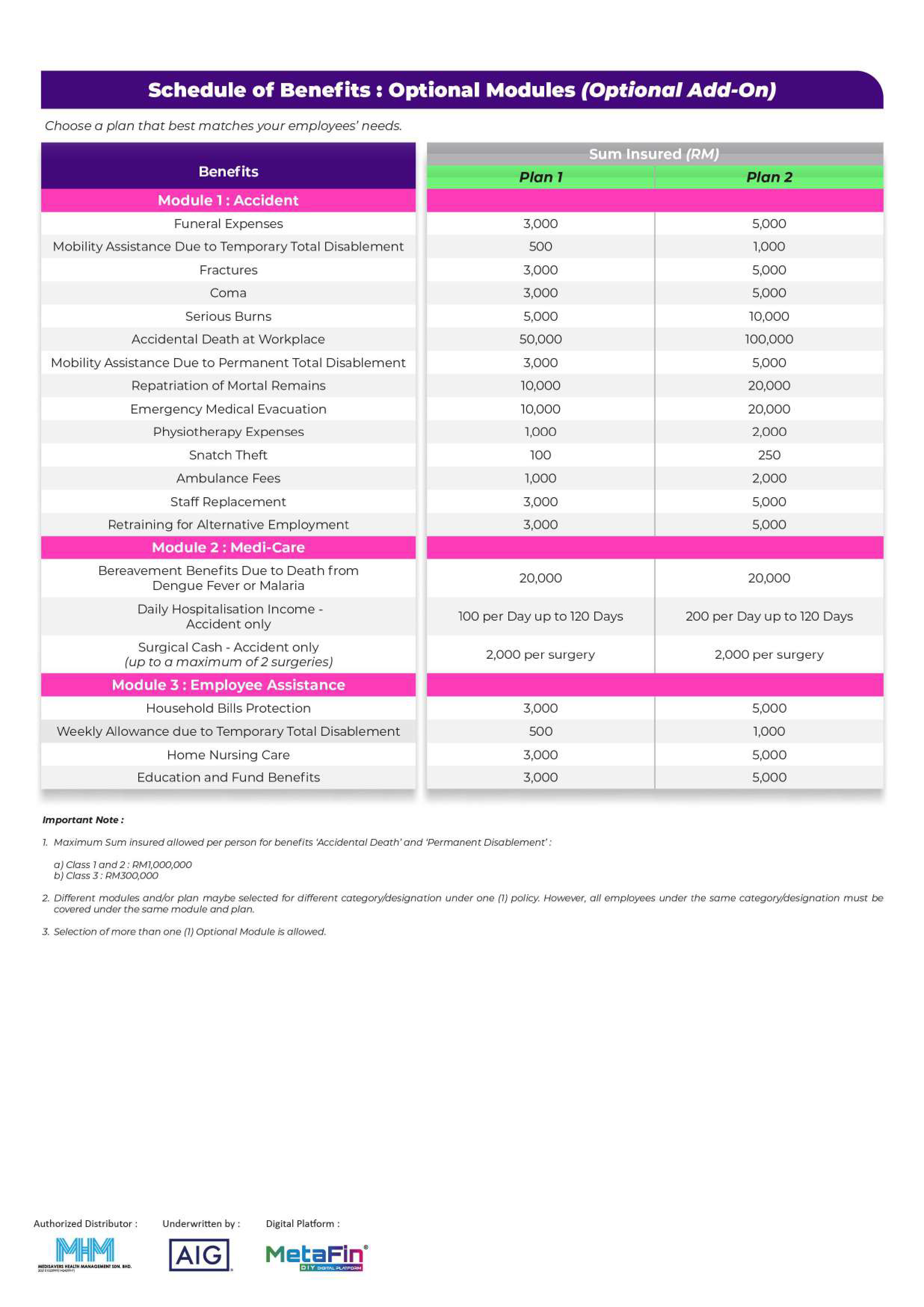

This product has 1 mandatory Core Module and 3 Optional Modules as follows. Each Optional Module has 2 Plans.

i) Mandatory Module:

a) Core Module

ii) Optional Modules:

a) Accident Module

b) Medi-Care Module

c) Employee Assistance Module -

What is the process for claims to be notified and submitted?

- All claims must be notified within 30 days from the date of loss.

- All supporting documents proving the loss must be submitted within 90 days from the date of loss.

- No claim can be admissible if notified one year from the date of loss.

- All claims will be paid to the employer.

-

What age requirement must my employees be to apply?

Each employee must be between 18 to 75 years of age to qualify.

-

What does it mean by ‘unnamed’ basis?

This is based on the number of employees declared to the company under the classification of occupation class stated in the schedule. New employees will be automatically covered subject to:

i) Categories where the occupation has changed from occupations declared at the inception of the Policy; or

ii) any Category or inclusions from any new acquisition or subsidiary where the nature of business differs from the declared nature of business of the Policyholder; or

iii) any increase in the total number of employees by more than 20% or 5 persons (whichever higher) of the current headcount

If the number of employees is more than the number of employees declared in the classification of occupation class stated in the schedule, the company shall not be liable to pay or contribute more than its rationable proportion of any loss. Otherwise, this is subject to the terms and conditions of the policy. -

What is the basis of declaration?

This policy is arrange on a headcount basis. The declaration must include the employee’s designation and the plan he/she is covered for.

-

What are the occupation class?

Occupation Class 1 and 2 – Persons engaged in professional, managerial, administrative, supervisory or clerical work and not involved in any manual labour or any work which is hazardous in nature.

Occupation Class 3 – Persons engaged in occasional or regular manual work that is not hazardous in nature but involving the use of tools or light machinery.

-

Can I cancel my policy?

An employer may cancel the policy at any time by providing a 30 days written notice. The employer will be entitled to a refund of the premium on a prorate basis for the unexpired period of insurance.

Important Documents

Disclaimer: Personal Accident Insurance (Group Employee Care by AIG) is underwritten by AIG Malaysia Berhad, and MediSavers Health Management Sdn. Bhd. has been appointed by AIG Malaysia Berhad to act as an authorized insurance agency. The information herein may not fully reflect the context of the product disclosure sheet and full terms of the policy. Please refer to the policy documents for a detailed description of the product's features and the conditions under which any claims are made. MetaFin is not liable for misinterpretation of the product benefits and claim conditions as described in the policy wording sheet and product disclosure sheet. For any claims assistance, complaints or product information, please contact us at mhmproductinquiry@gmail.com for further assistance.