Boost your employee benefits!

Reach out to a Benefits Specialist today for a quotation.

Get a Quick Quote

| Medical Provider | Phone Number | |

|---|---|---|

| COLUMBIA ASIA HOSPITAL - ISKANDAR PUTERI | Johor | 03-7886 4916 |

| COLUMBIA ASIA HOSPITAL - TEBRAU | Johor | 03-2693 1007 |

| GLENEAGLES HOSPITAL MEDINI JOHOR | Johor | 03-6141 8533 |

| HOSPITAL PENAWAR SDN. BHD. | Johor | 03-8923 5500 |

| KEMPAS MEDICAL CENTRE | Johor | 05-623 2999 |

| KPJ BANDAR DATO' ONN SPECIALIST HOSPITAL | Johor | 05-805 6000 |

| KPJ BANDAR MAHARANI SPECIALIST HOSPITAL | Johor | 03-5639 1212 |

| KPJ BATU PAHAT SPECIALIST HOSPITAL | Johor | 03-7872 3000 / 03-7680 7000 |

| KPJ JOHOR SPECIALIST HOSPITAL | Johor | 06-850 5000 |

| KPJ KLUANG SPECIALIST HOSPITAL | Johor | 09-513 7110 / 7111 |

| KPJ PASIR GUDANG SPECIALIST HOSPITAL | Johor | 03-5515 1888 |

| KPJ PUTERI SPECIALIST HOSPITAL | Johor | 03-5515 1888 |

| MARIA HOSPITAL | Johor | 04-371 0000 |

| OASISEYE SPECIALISTS (JOHOR BAHRU) | Johor | 03-7620 7979 |

| PANTAI HOSPITAL BATU PAHAT | Johor | 086-330 333 |

| PUTRA SPECIALIST HOSPITAL (BATU PAHAT) SDN. BHD. | Johor | 082-507 333 |

| REGENCY SPECIALIST HOSPITAL | Johor | 085-329 333 |

| TOP VISION EYE SPECIALIST CENTRE (BATU PAHAT) SDN. BHD. | Johor | 03-3884 3884 |

| TOP VISION EYE SPECIALIST CENTRE (KULAI) SDN. BHD. | Johor | 03-2276 7000 |

| TOP VISION EYE SPECIALIST CENTRE (SOUTHKEY) | Johor | 03-2242 7000 |

| KEDAH MEDICAL CENTRE | Kedah | 06-763 1688 |

| METRO SPECIALIST HOSPITAL | Kedah | 086-251 888 |

| PANTAI HOSPITAL LAGUNA MERBOK | Kedah | 03-5125 9999 |

| PANTAI HOSPITAL SUNGAI PETANI | Kedah | 03-5125 9999 |

| PUTRA MEDICAL CENTRE | Kedah | 07-233 9999 |

| KOTA BHARU MEDICAL CENTRE | Kelantan | 03-3346 7999 |

| KPJ PERDANA SPECIALIST HOSPITAL | Kelantan | 085-437 755 |

| MAHKOTA MEDICAL CENTRE SDN. BHD. | Melaka | 03-7949 9999 |

| ORIENTAL MELAKA STRAITS MEDICAL CENTRE | Melaka | 03-8064 8688 |

| PANTAI HOSPITAL AYER KEROH | Melaka | 06-603 3988 |

| PUTRA SPECIALIST HOSPITAL (MELAKA) SDN. BHD. | Melaka | 03-4145 9999 |

| AURELIUS HOSPITAL NILAI | Negeri Sembilan | 05-820 8888 |

| CMH SPECIALIST HOSPITAL | Negeri Sembilan | 07-272 9999 |

| COLUMBIA ASIA HOSPITAL - SEREMBAN | Negeri Sembilan | 03-4043 4900 |

| KPJ SEREMBAN SPECIALIST HOSPITAL | Negeri Sembilan | 09-534 9988 |

| MAWAR MEDICAL CENTRE | Negeri Sembilan | 03-4141 3000 |

| OASISEYE SPECIALISTS (SEREMBAN) | Negeri Sembilan | 07-560 1000 |

| SALAM SENAWANG SPECIALIST HOSPITAL | Negeri Sembilan | 088-518 888 |

| UCSI HOSPITAL | Negeri Sembilan | 04-222 9111 |

| AURELIUS HOSPITAL PAHANG | Pahang | 04-228 6557 |

| DARUL MAKMUR MEDICAL CENTRE | Pahang | 05-545 5777 |

| IIUM MEDICAL SPECIALIST CENTRE (IMSC) | Pahang | 03-8921 2612 / 03-8921 2525 |

| KMI KUANTAN MEDICAL CENTRE | Pahang | 04-657 1888 / 04-652 8888 |

| KPJ PAHANG SPECIALIST HOSPITAL | Pahang | 03-7717 3000 |

| BAGAN SPECIALIST CENTRE | Penang | 07-252 1800 |

| GLENEAGLES PENANG | Penang | 03-2687 5000 |

| HOPE CHILDREN HOSPITAL - GOTTLIEB | Penang | 09-573 0380 / 09-573 0089 |

| HOSPITAL LAM WAH EE | Penang | 03-2617 8200 |

| ISLAND HOSPITAL | Penang | 04-228 8222 |

| KPJ PENANG SPECIALIST HOSPITAL | Penang | 03-8739 8979 |

| LOH GUAN LYE SPECIALISTS CENTRE | Penang | 04-730 8878 |

| OPTIMAX EYE SPECIALIST HOSPITAL (PENANG) | Penang | 07-236 8999 |

| PANTAI HOSPITAL PENANG | Penang | 03-6250 0077 |

| PENANG ADVENTIST HOSPITAL | Penang | 05-242 5333 |

| PUSAT PAKAR MATA OASISEYE SPECIALISTS (PENANG) | Penang | 03-7805 2111 |

| SUNWAY MEDICAL CENTRE PENANG | Penang | 04-373 9191 |

| ANSON BAY MEDICAL CENTRE | Perak | 09-590 2828 |

| APOLLO MEDICAL CENTRE | Perak | 03-7982 6500 |

| COLUMBIA ASIA HOSPITAL - TAIPING | Perak | 089-771 873 |

| HOSPITAL FATIMAH | Perak | 09-743 3399 |

| KMC MEDICAL CENTRE | Perak | 03-4289 5000 |

| KPJ IPOH SPECIALIST HOSPITAL | Perak | 07-301 1000 |

| PANTAI HOSPITAL IPOH | Perak | 06-956 4500 |

| PANTAI HOSPITAL MANJUNG | Perak | 07-459 1000 |

| PERAK COMMUNITY SPECIALIST HOSPITAL | Perak | 03-7718 1000 |

| KPJ PERLIS SPECIALIST HOSPITAL | Perlis | 05-240 8777 / 05-240 8759 |

| TAIPING MEDICAL CENTRE | Perlis | 07-225 3000 |

| GLENEAGLES KOTA KINABALU | Sabah | 03-8769 2999 |

| KMI TAWAU MEDICAL CENTRE | Sabah | 03-3377 7888 |

| KPJ SABAH SPECIALIST HOSPITAL | Sabah | 07-771 8999 |

| RAFFLESIA MEDICAL CENTRE SDN. BHD. | Sabah | 082-365 777 |

| JESSELTON MEDICAL CENTRE KOTA KINABALU | Sabah | 088-366 333 |

| BINTULU MEDICAL CENTRE | Sarawak | 086-330 333 |

| BORNEO MEDICAL CENTRE | Sarawak | 082-507 333 |

| BORNEO MEDICAL CENTRE (MIRI) | Sarawak | 085-329 333 |

| COLUMBIA ASIA HOSPITAL - BINTULU | Sarawak | 086-251 888 |

| COLUMBIA ASIA HOSPITAL - MIRI | Sarawak | 085-437 755 |

| KPJ KUCHING SPECIALIST HOSPITAL | Sarawak | 082-365 777 |

| KPJ MIRI SPECIALIST HOSPITAL | Sarawak | 085-649 999 |

| MIRI CITY MEDICAL CENTRE | Sarawak | 085-426 622 |

| NORMAH MEDICAL SPECIALIST CENTRE | Sarawak | 082-440 055 |

| REJANG MEDICAL CENTRE | Sarawak | 084-323 333 |

| SIBU SPECIALIST MEDICAL CENTRE | Sarawak | 084-329 900 |

| ACC@EVESUITE MEDICAL CENTRE | Selangor | 06-767 7800 |

| ALPHA SPECIALIST CENTRE | Selangor | 03-4026 7777 |

| AN-NUR SPECIALIST HOSPITAL | Selangor | 03-8062 4073 |

| ARA DAMANSARA MEDICAL CENTRE | Selangor | 04-238 8888 |

| ASSUNTA HOSPITAL | Selangor | 03-4042 5335 |

| AVISENA SPECIALIST HOSPITAL | Selangor | 06-285 2999 |

| AVISENA WOMEN'S & CHILDREN'S SPECIALIST HOSPITAL | Selangor | 07-2243 888 |

| BEACON HOSPITAL | Selangor | 06-764 7048 |

| BUKIT TINGGI MEDICAL CENTRE | Selangor | 04-423 8888 |

| COLUMBIA ASIA HOSPITAL - BUKIT RIMAU | Selangor | 085-426 622 |

| COLUMBIA ASIA HOSPITAL - CHERAS | Selangor | 03-5526 2600 |

| COLUMBIA ASIA HOSPITAL - KLANG | Selangor | 082-440 055 |

| COLUMBIA ASIA HOSPITAL - PETALING JAYA | Selangor | 03-2730 7676 |

| COLUMBIA ASIA HOSPITAL - PUCHONG | Selangor | 07-272 8686 |

| HOSPITAL ISLAM AZ-ZAHRAH | Selangor | 03-2730 7688 |

| KAJANG PLAZA MEDICAL CENTRE | Selangor | 03-7722 3177 |

| KMI KELANA JAYA MEDICAL CENTRE | Selangor | 04-282 3522 |

| KPJ AMPANG PUTERI SPECIALIST HOSPITAL | Selangor | 06-315 8888 |

| KPJ DAMANSARA SPECIALIST HOSPITAL | Selangor | 03-4289 2828 |

| KPJ KAJANG SPECIALIST HOSPITAL | Selangor | 06-231 9999 |

| KPJ KLANG SPECIALIST HOSPITAL | Selangor | 07-433 8811 |

| KPJ PUSAT PAKAR MATA CENTRE FOR SIGHT | Selangor | 03-9145 2888 |

| KPJ RAWANG SPECIALIST HOSPITAL | Selangor | 05-540 5555 |

| KPJ SELANGOR SPECIALIST HOSPITAL | Selangor | 03-3258 5500 |

| KPMC PUCHONG SPECIALIST CENTRE | Selangor | 03-2296 0888 |

| MSU MEDICAL CENTRE | Selangor | 04-442 3888 |

| PANTAI HOSPITAL KLANG | Selangor | 05-689 8555 |

| PUSAT PAKAR MATA AESC EYE SPECIALIST CENTRE | Selangor | 04-643 3888 |

| PUTRA MEDICAL CENTRE (SG BULOH) | Selangor | 04-445 8888 |

| QHC MEDICAL CENTRE | Selangor | 03-5639 1212 |

| SALAM SHAH ALAM SPECIALIST HOSPITAL | Selangor | 04-222 7200 |

| SENTOSA SPECIALIST HOSPITAL | Selangor | 05-241 9000 |

| SRI KOTA SPECIALIST MEDICAL CENTRE | Selangor | 03-2160 0000 |

| SUBANG JAYA MEDICAL CENTRE | Selangor | 03-8940 0388 |

| SUNGAI LONG SPECIALIST HOSPITAL | Selangor | 04-372 3838 |

| SUNWAY MEDICAL CENTRE | Selangor | 04-734 2888 |

| SUNWAY SPECIALIST CENTRE DAMANSARA | Selangor | 03-6156 4735 / 03-6141 4311 |

| THE TUN HUSSEIN ONN NATIONAL EYE HOSPITAL | Selangor | 07-413 3333 |

| THOMSON HOSPITAL KOTA DAMANSARA | Selangor | 06-283 5888 |

| TOP VISION EYE SPECIALIST CENTRE (KUALA SELANGOR) SDN. BHD. | Selangor | 03-8024 5760 / 03-8024 6760 |

| TOP VISION EYE SPECIALIST CENTRE (SETIA ALAM) SDN. BHD. | Selangor | 03-7727 0633 / 012-491 3220 |

| TOP VISION EYE SPECIALIST CENTRE SDN. BHD. | Selangor | 088-272 620 / 088-272 630 |

| UITM PRIVATE SPECIALIST CENTRE | Selangor | 07-257 3999 |

| KMI KUALA TERENGGANU MEDICAL CENTRE | Terengganu | 084-330 733 / 084-323 333 / 084-314 733 |

| SALAM SPECIALIST HOSPITAL, KUALA TERENGGANU | Terengganu | 06-675 1188 |

| AL-ISLAM SPECIALIST HOSPITAL | Wilayah Persekutuan | 03-5543 4000 |

| CARDIAC VASCULAR SENTRAL KUALA LUMPUR | Wilayah Persekutuan | 09-620 0200 |

| CENTRE FOR GI & LIVER DISEASES (CENGILD) | Wilayah Persekutuan | 03-5162 8814/ 8819/ 8820 |

| COLUMBIA ASIA HOSPITAL - SETAPAK | Wilayah Persekutuan | 084-329 900 |

| DAMAI SERVICE HOSPITAL (HQ) SDN. BHD. | Wilayah Persekutuan | 03-3375 7799 |

| GLENEAGLES HOSPITAL KUALA LUMPUR | Wilayah Persekutuan | 03-5639 1212 |

| HOSPITAL PAKAR DAMANSARA 2 | Wilayah Persekutuan | 03-9010 3788 |

| HOSPITAL PUSRAWI SDN. BHD. | Wilayah Persekutuan | 03-7491 9191 / 03-5566 9191 |

| INSTITUT JANTUNG NEGARA | Wilayah Persekutuan | 04-373 9191 |

| KL EYE SPECIALIST CENTRE | Wilayah Persekutuan | 03-9772 9191 |

| KMI TAMAN DESA MEDICAL CENTRE | Wilayah Persekutuan | 03-6411 9191 |

| KPJ SENTOSA KL SPECIALIST HOSPITAL | Wilayah Persekutuan | 04-970 7777 |

| KPJ TAWAKKAL KL SPECIALIST HOSPITAL | Wilayah Persekutuan | 03-7718 1488/ 03-7718 1588 |

| LOURDES MEDICAL CENTRE | Wilayah Persekutuan | 03-6287 1111 |

| OASISEYE SPECIALISTS | Wilayah Persekutuan | 082-234 466 |

| OPTIMAX EYE SPECIALIST CENTRE (TTDI) | Wilayah Persekutuan | 07-4394 998 / 07-4394 988 |

| PANTAI HOSPITAL AMPANG | Wilayah Persekutuan | 03-3289 5000 / 03-3289 5500 |

| PANTAI HOSPITAL CHERAS | Wilayah Persekutuan | 016-9299819 |

| PANTAI HOSPITAL KUALA LUMPUR | Wilayah Persekutuan | 03-3343 9911 |

| PARKCITY MEDICAL CENTRE | Wilayah Persekutuan | 016-7557298 |

| PRINCE COURT MEDICAL CENTRE SDN. BHD. | Wilayah Persekutuan | 03-3181 8993 |

| QUILL ORTHOPAEDIC SPECIALIST CENTRE | Wilayah Persekutuan | 03-2037 2288 |

| SUNWAY MEDICAL CENTRE VELOCITY | Wilayah Persekutuan | 06-648 8888 |

| TUNG SHIN HOSPITAL | Wilayah Persekutuan | 03-6144 1600 |

| UKM SPECIALIST CENTRE | Wilayah Persekutuan | 03-9174 9222 |

| UMSC AMBULATORY CARE & SPECIALIST CLINIC | Wilayah Persekutuan | 03-7841 4000 |

LOCAL Hospital Admission Assistance : Allianz Care Services

1-300-88-8322 1

1

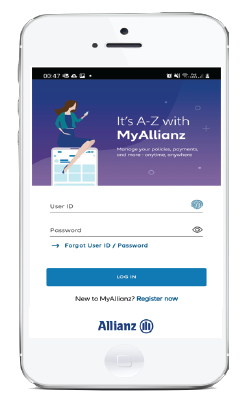

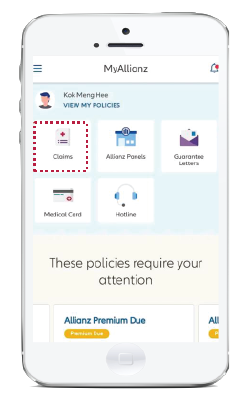

Login MyAllianz App

2

2

Select “Claims”

3

3

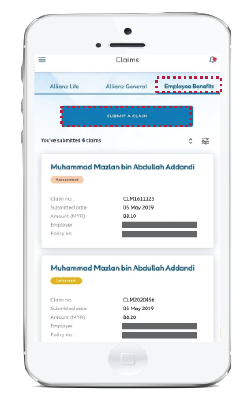

Click on “Employees Benefit” then click “SUBMIT A CLAIM”

4

4

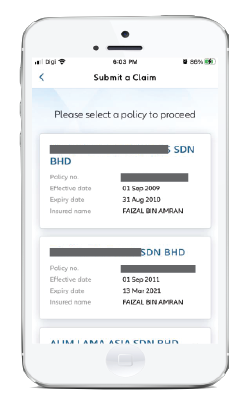

Select policy & fill in claim info.

5

5

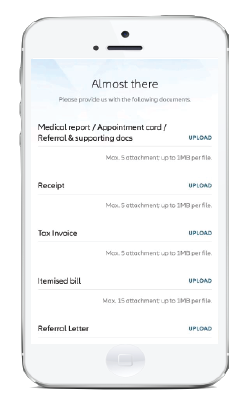

Upload claims photo & submit

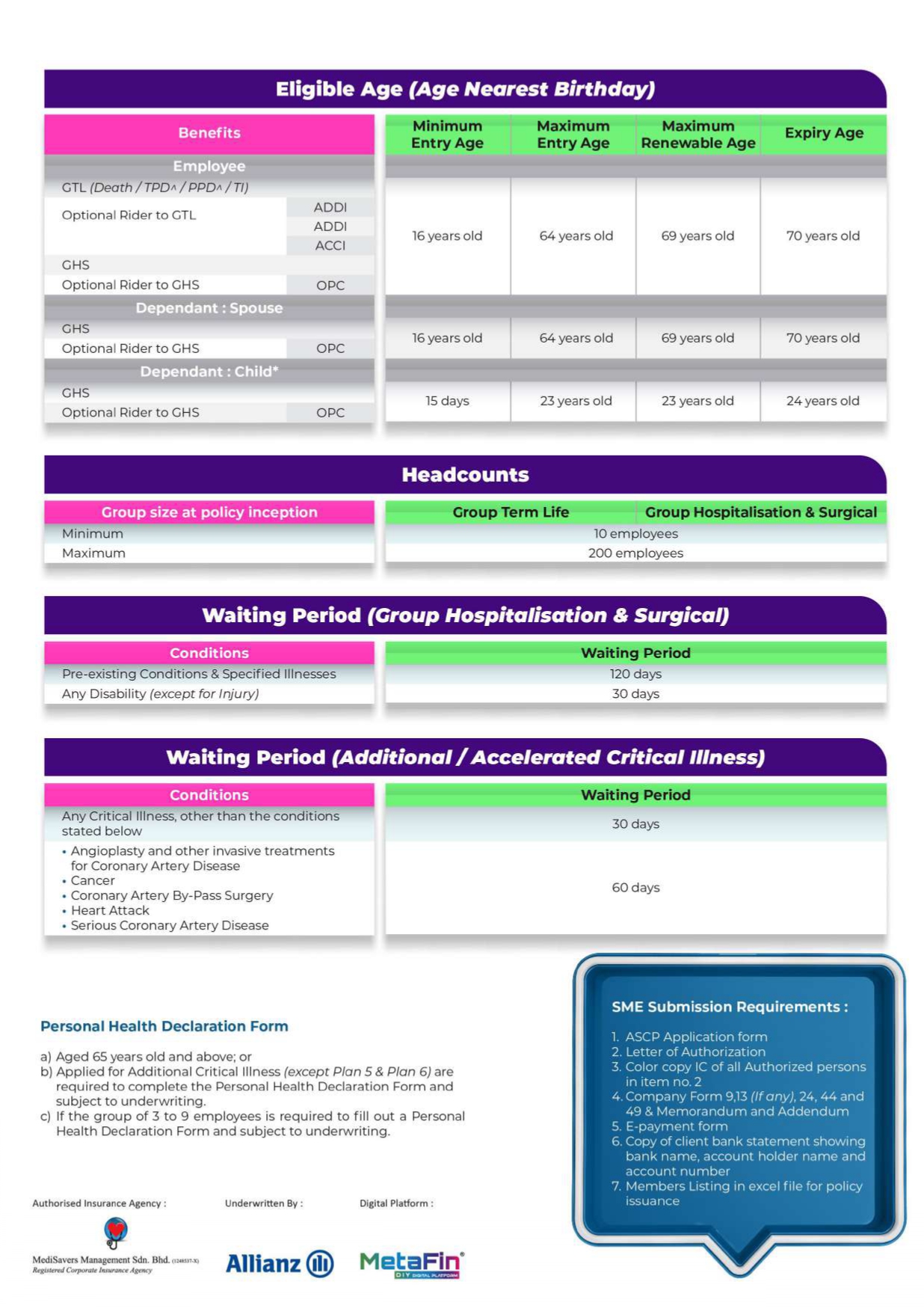

Only employees who are:

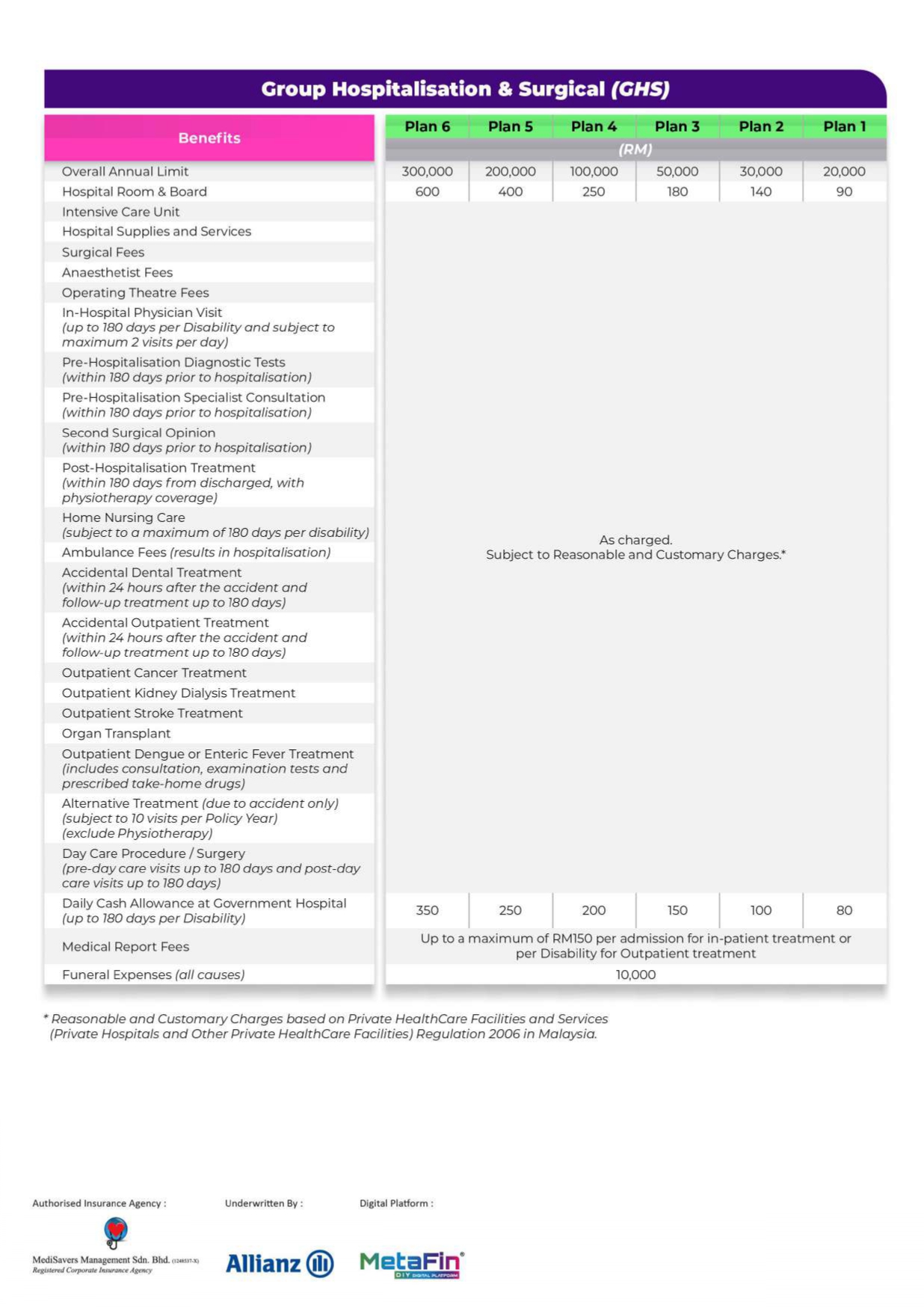

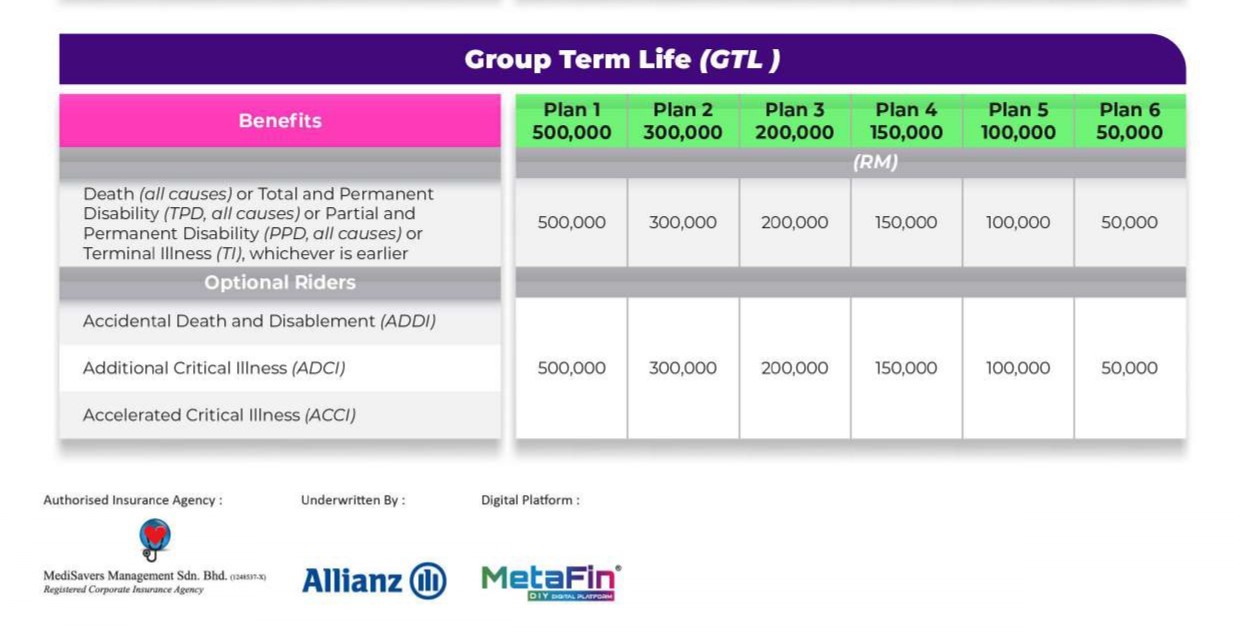

Premium payment options for the following insurance plans include Group Hospital and Surgical, Death and Disability, and Outpatient Clinical. Please note that only the 'Annual' mode of payment is allowed.

For payment, use the following details:

Account name: ALLIANZ LIFE EMPLOYEE BENEFITS

Bank name: HSBC BANK MALAYSIA BERHAD

Account number: 448500611001

Additionally, for the Add-on program, payments should be made to the authorized insurance agency:

Name: Pathlab Health Management (M) Sdn. Bhd.

Maybank (MBB) account no.: 514 178 430 725

Public Bank (PBB) account no.: 311 966 1229

“Cash Before Cover” is applicable for policies with annual premium of less than RM10,000 excluding stamp duty and service tax. “Cash Before Cover” means that the premiums must be paid before the insurance policy can be issued.

A minimum premium of RM2,000 excluding stamp duty and service tax is required to incept a new policy

The benefits will be paid to whom you have nominated as your beneficiaries. For Total and Permanent Disability claim or Accelerating Critical Illness claim, the benefits will be payable to you.

Yes, the insurance coverage will only continue to remain inforce until the next premium due date and shall cease thereafter.

Yes, if the master policy has been terminated, the insurance coverage will only continue to remain inforce until the next premium due date and shall cease thereafter.

No, reinstatement of a lapsed policy is not allowed. Therefore, it is important that you pay yourpremium on time.

Disclaimer: MetaFin users have the option to directly self-sign up for the Group Medical Insurance in the MetaFin DIY Digital Platform. This program is underwritten by Allianz Malaysia Berhad, and the enrollment process is facilitated by authorized insurance agency MediSavers Management Sdn. Bhd. The information herein may not fully reflect the context of the product disclosure sheet and full terms of the policy. Please refer to the documents for a detailed description of the product's features and the conditions under which any claims are made. MetaFin is not liable for misinterpretation of product benefits and claim conditions as described in the policy wording sheet and product disclosure sheet.